Perks of a company car are enjoyed by many employees offered by the companies. There are some companies who even offer you car fuel benefits in kind. However, some people confuse this as free fuel to use, but this is not the case at all because the Government of the UK considers this as a taxable benefit which can be further claimed by the company as a car fuel benefit in kind.

Further in this article, we will discuss to understand how to define car fuel benefits, ways to calculate them, and seeing it with all the aspects to figure out whether it is actually advantageous offer by the company. Before we delve into the discussion, let’s have a look at focused points of this article:

- Explanation of the Company Car Fuel Benefit in Kind

- Calculate The Company Car Fuel Benefit

- The Bottom Line

Get professional advice on the company car fuel that you are using. Why not speak to one of our qualified professionals? Give us a call on 0203 4411 258 or request a callback. We are available from 9:00 am – 05:30 pm Monday to Friday.

Explanation of the Company Car Fuel Benefit in Kind:

Many people consider a company car with the fuel is just a simple offer or a perk to working for a good organisation – but it is just not that only. A bit more to this is not understood by people commonly, this is actually a tax that we have to pay to HMRC.

Yes, the company car and the fuel that is offered to you by the company that you serve for the business affairs is actually the tax that you will pay to HMRC. Fleet management fuel cards and allowance of personal fuel are some examples related to this. Moreover, the fuel card can save you from spending a lot of money. There are several swift options to reclaim your fuel expenses that can be done within a few seconds on comparison sites.

Looking for more information to grow your business valuation? Let us take care of your inclusive monthly package affairs so that you can focus on your business.

Calculate The Company Car Fuel Benefit:

Now that you know that company car fuel is a tax that you have to pay because it is considered as a free thing that you use even for personal affairs in other than the working hours. If you wonder bout how much you need to pay and how this amount can be calculated.

The calculation can be unique and vary depending on vehicle benefit in kind. This is very obvious by now that the tax is actually for the free fuel that you use for personal use in off working hours as well.

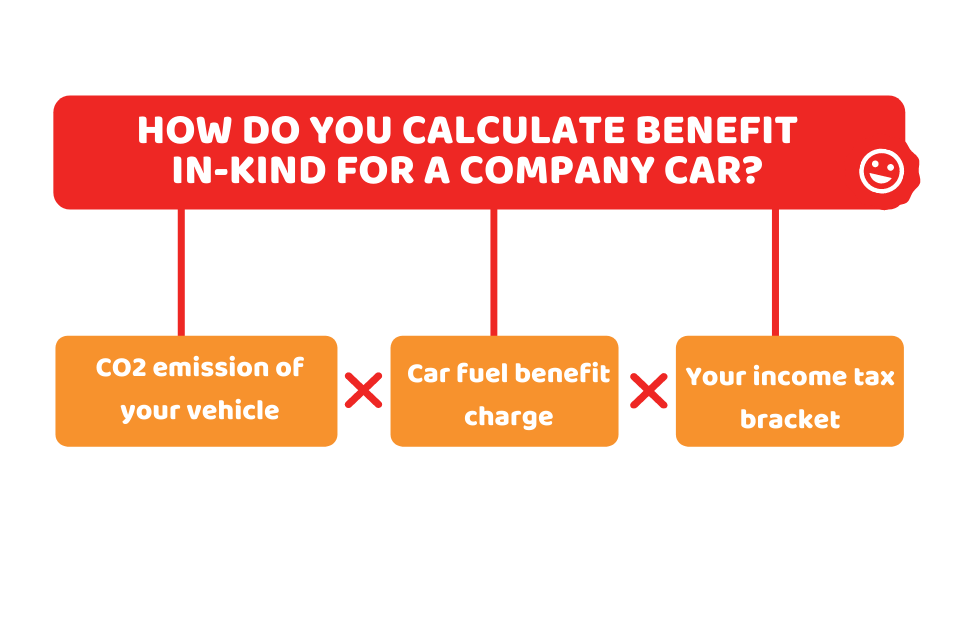

To calculate the company car fuel benefit, you need to know the BIK of your car, which can be explained as follows:

CO2 emission of your vehicle x car fuel benefit charge x your income tax bracket

Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

The Bottom Line:

Now that you have developed a better understanding of car fuel benefits in kind, we can sum up the discussion by saying that if a person intends to get the benefit of company car fuel then it is a mandatory factor to have a clear understanding of the charges of the fuel benefits. This will further help to decide whether accepting the offer of company car fuel benefits is advantageous and worth going for.

We hope this article helped to provide enough information that will help you to make the right decision about your company car and fuel offers.

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

Disclaimer: This article intends to provide general information based on car fuel benefits in kind and relevant details.