When you set up your business, one of the first things you need to do is open a business bank account. Opening a bank account can be a hassle due to the considerable paperwork, time and money involved. However, the Tide business account can be the best alternative to traditional banking.

It allows you to take and receive payments without any monthly charges. Besides, it takes few minutes to set up and operate this online account.

Let’s dive into the details of this account and see whether it’s a suitable alternative to the bank account or not.

Accotax is an accounting firm that offers inclusive financial services for small business owners, self-employed, landlords and freelancers at a reasonable price. If you’re the one, you may contact us today!

What is Tide?

Founded in 2015, Tide is a privately owned UK financial technology company. This company has brought dynamism to the banking industry attracting more than 200,000 customers after its launch. Although, it is not itself a bank but works similarly to a normal bank offering a business bank account with an innovative touch.

With Tide, you are provided with a sort code and account number plus all the services that banks offer like Direct debit, standing order, etc. However, it doesn’t work the same as an ordinary bank, it offers tech-savvy features that make it different from traditional banks.

In short, we can say that it is a progressive company that has added innovation to the banking sector. Whilst opening an account here, you need to ensure that it suits your business needs. Let’s delve deeper into the details of this business account!

What is Tide Business Bank Account?

Tide business bank account is designed for modern, tech-savvy individuals and businesses. It aims to reduce the administrative burden of small business owners and sole traders.

One of the best attributes of this account is it doesn’t charge a penny if you’re new and you’re not making any money. If you start making money, you have to pay a small 20% charge for each transfer. Moreover, you can do card payments with this account without any charges.

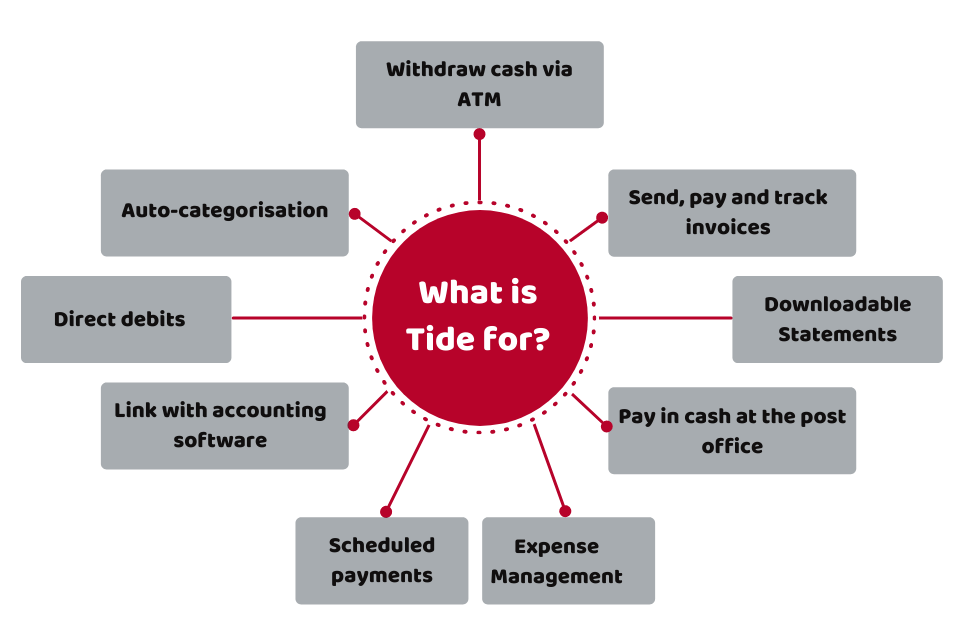

What is Tide for?

Along with the features of a normal bank account, it offers few additional features. For this reason, it’s feasible for many small businesses.

- You can do expense management

- It allows you to set up direct debits

- You can set up scheduled payments

- It allows you to download your online bank statement

- It allows you to create separate accounts for multiple purposes

- You are provided with the business Mastercard

- You can link it with your accounting software

- It allows you to pay cash at the post office

- It allows you to withdraw cash via ATM

The Tide business account is feasible for cash-based businesses, businesses who use online payment methods and those using the services of the payment providers like PayPal, Stripe, GoCardless, etc. In this way, it best suits for:

- Startups

- Small Businesses

- Medium-sized businesses

- Sole traders

- Self Employed

- Freelancers

- Small Shops

- Independent traders

- Tradespeople

Pros

Here are the advantages of the Tide business account:

- Easy to use and set up the mobile app

- Simple to manage and track payments

- No Monthly Fees

- Fast onboarding and local transfer

Cons

Here are the drawbacks of this account:

- It doesn’t support international payments

- Doesn’t accept cheque payments

- Need to pay extra amount for dedicated support

- It doesn’t allow you to open a personal account

- Not for businesses that handle large cash

Quick Sum Up

To sum up, a Tide business account frees up a lot of hassle and administration out of normal business banking. Notably, it saves a lot of time that is wasted on appointments at the bank and you can set up your account quickly within minutes. In addition, you can manage your business finances with an online app using your mobile. So, if you are a small business looking for a decent technology to sent and receive payments then it’d be a great option. However, if you need regular customer support, you need to go for the paid packages of this account.

Managing business finance yourself can be a daunting task. Save your time, money and stress and focus on your business growth by allowing us to handle your business finances. We have a team of qualified accountants, bookkeepers and tax experts for your support! Get in touch with us now!

Looking for a customized service, get an instant quote right away!

Disclaimer: This blog is intended for general information on the Tide business account.