If you are renting a commercial space as a small business, you may need to customise it as per your business needs. The change or improvement you made to enhance the rental property is called leasehold improvement. Let’s see what they are, whether they are amortised, and how to do accounts for them. Read on till the end to find out!

Rely on ACCOTAX – Accountants in London to get bespoke accounting and tax services at a competitive price. Give us a call on 0203 4411 258 or request a callback. Contact now!

Understanding Leasehold Improvements

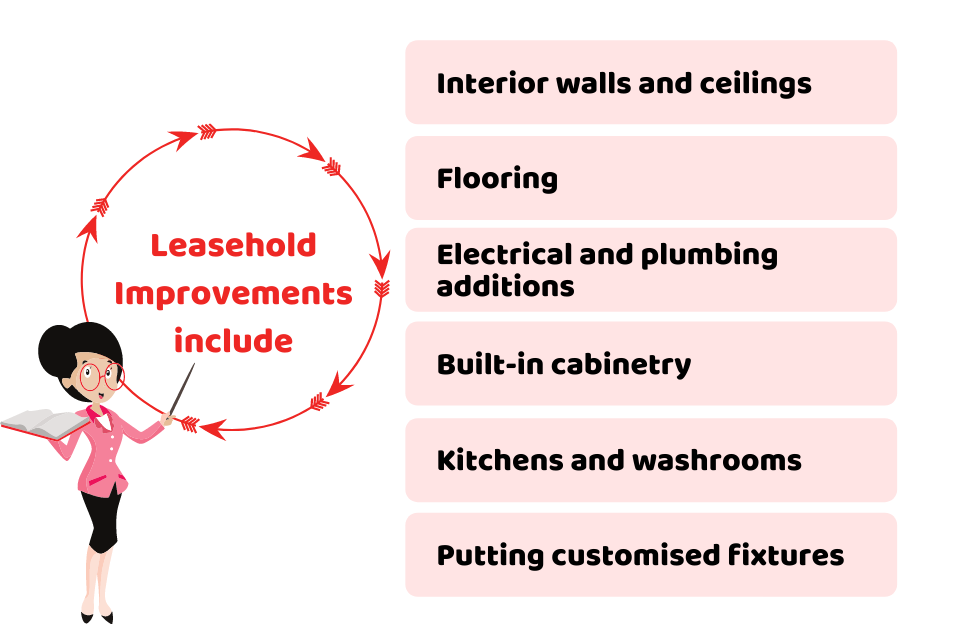

Also known as tenant improvements, it may refer to the alterations, additions, or installations made to customise a rental property as per the needs of the tenants. Here are some of the examples of these improvements:

- Interior walls and ceilings

- Flooring

- Electrical and plumbing additions

- Built-in cabinetry

- Kitchens and washrooms

- Putting customised fixtures

These improvements are generally made by a tenant or a landlord, and most of the time, they are paid for by the tenant. Normally, the useful economic life of such improvements is 5 to 10 years. So, you need to work out amortisation as per the economic life of the rental space.

Are Leasehold Improvements Amortised?

The improvements made to a rental property are not depreciated; instead, they are amortised. Once they are installed, they become the owner’s property, and you only exercise an intangible right to use those improvements during the lease tenure. For this reason, they are amortised, not depreciated. To understand, let’s have a look at this example.

For instance, if you (as a business owner) install new furniture after signing a 10-year lease and the furniture needs to be replaced after 5 years, it means that the cost of the furniture is amortised over the 5-year period. This amortising is a gradual write-off of the initial value of the improvement over a period.

If the improvements last longer than the term, like from a 10-year lease it becomes 4 years, then in such a case, the cost of the enhancements made will be amortised for four years. As the furniture will remain in that place after the leasehold and the tenant will not retain it. So in this way, amortisation works on a lease-term basis.

Save your time, money, and stress by allowing us to manage your accounts and taxes. Accotax has a team of accountants and tax experts to save your pennies against unwanted taxes. Contact us right now!

How to Account for Leasehold Improvement?

The cost involved in purchasing things for leasehold improvement would be your assets (at least during the lease tenure). To account for these things in your accounting records, you need to have a basic understanding of accounting principles and be familiar with accounting software to carry out this task. With this knowledge, you can easily follow these steps:

- First, you need to create a new asset account on your balance sheet and name it as leasehold improvements, along with creating a contra account naming leasehold improvement depreciation (to keep track of its depreciation)

- Check your accounting software program’s instructions for adding additional/new accounts

- Aggregate all associated costs for the improvement

- Enter the total cost in your accounting records; normally, the transaction is debited to the new asset account and credited to your credit card account

- The new assets will be on your balance sheet until the end of the year, when you will expense a portion of it as a depreciation expense.

- For recording depreciation, you need to debit a depreciation expense account and credit your leasehold improvement depreciation account.

By following this, you will be able to find the original cost of improvements, and it will allow you to keep track of your expenses separately. In this instance, you need to keep all your improvement receipts. This will allow you to provide evidence to HMRC if required. Once you make all your entries, you need to prepare a balance sheet and income statement to make sure that your entries are getting the desired results.

Quick Sum Up

So, we hope that you have enough information on what leasehold improvements are, how they are amortised, and how to account for leasehold improvements. These improvements are the modifications done to a leased property to meet the needs of the tenants. They are taken as assets and are amortised. With a basic knowledge of accounting principles and software, you can do accounting for them based on the above-given steps.

It is better to consult our property accountants before making a leasehold purchase. We offer inclusive financial services for small business owners, the self-employed, and landlords at a reasonable price. You may get in touch now!

Disclaimer: This blog post is intended just for a general understanding of the topic.