An Umbrella Company is a great employment platform for the self-employed contractors who choose to work through it rather than setting up their own company. For these contractors, umbrella companies UK act as an employer to provide work on fixed terms. It is advantageous for the freelancers who work under IR35. However, the advantages depend on the status of IR35.

What is IR35?

One can work inside or outside IR35, it applies to the contracts only.

- Want to Learn more about IR35? Contact Accotax!

- Seek a guide to know your IR35 status.

Why Choose Umbrella Companies?

The idea of setting up a limited company or work being a sole trader often comes with rollercoaster full challenges. Which doesn’t make it a suitable decision for the contractors or freelancers who seek to work on a contract basis.

Being new to the world of business that is full of competitors, you may not want to jump into the hassle of being a sole trader and want to learn through temporary contracts. Even if you don’t want to invest your energies in record-keeping or playing daily reports, there is the option to work away from the administration. Some prominent features that attract people to work with Umbrella Companies UK also include the following:

- Working on a contract basis but having an employer

- Umbrella companies also take care of your tax returns, so, you don’t have to worry about it.

- It organizes payments for the contractors.

- They do not charge any fees.

Contact our professionals to know how umbrella companies can benefit you.

Pros and Cons of Umbrella Companies UK:

Like limited companies and working as sole traders come up with their fun factors and disadvantages, the same way working with Umbrella Companies UK comes with its pros and cons too.

Advantages:

- It is hassle-free to work with umbrella companies UK.

- The contractors enjoy the flexibility of work.

- There is an option of working away from administration if you don’t want to pool in energies for record-keeping.

- The new contractors and freelancers learn with this experience before they move straight away to build up their own companies.

- The easiest way to get paid and not to worry about the taxes.

Disadvantages:

- Working with umbrella companies means all your income comes in the form of salary. • Membership fee is deducted which can be around 30 pounds per week.

- You don’t have the authority or the right to make decisions.

- It can be useful only for short-term contractors.

- They put you on payroll via PAYE

Reach out for affordable accounting and taxation services!

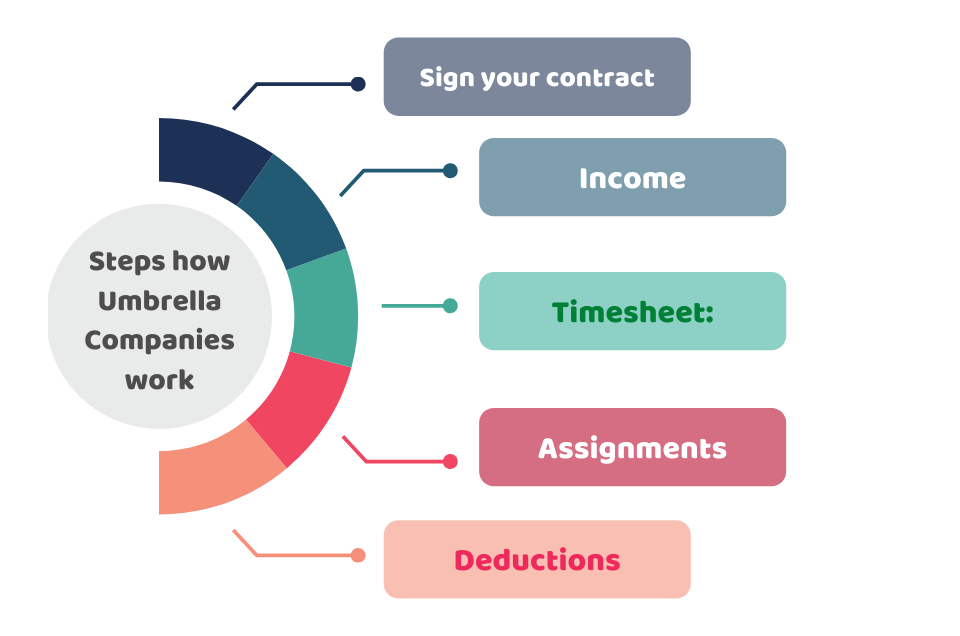

Step by step Guide to how Umbrella Companies work?

Once you are done with gathering information based on the pros and cons of working with umbrella companies uk, you are good to go and seek the guide to understand how do umbrella companies the UK actually work?

- Sign your contract: Umbrella companies sign the contract with the clients as well as the contractors for smooth working terms and conditions in the future. The most beneficial terms and conditions are often in the favor of the company but not the contractors who are getting their income in the form of salary.

- Income: After all the membership deductions, the contractors get their income in the form of salary. They do give you your salary slip along with it. Like, in most of the organizations worldwide where the employees get the income in the form of salary after the deductions.

- Timesheet: You have to submit your timesheets on a weekly basis. In the timesheet, you put the specific details about your work hours and pace. Timesheet also specifies the word limit and your agreement to the workload. The timesheet is checked and signed by the manager as well.

- Assignments: They will have temporary assignments given to you on fixed terms and conditions. where working with umbrella companies have the flexibility of the work environment, it also has some exhausting factors that are not easy to digest if one is used to working in a free work environment. This is because the contractors or the freelancers are not free to mold certain things their way and many of the people feel stuck working. Whereas, they still take it as a learning chance before pooling in for a limited company.

- Deductions: Your paid salary will have a deduction like income tax. This very factor often becomes a major disappointment and most freelancers do not appreciate working under such fixed circumstances.

To Conclude, we can say that for contractors or freelancers, it is easy to work with umbrella companies uk for temporary contracts under fixed terms. However, this often becomes unattractive when they realize the deductions and income comes in the form of salary. Although, it is still to be called a great option for young freelancers to learn before pooling in investments and energies for limited companies.

Want to learn more about umbrella companies UK? Contact us!