If you are using your car or vehicle for your employment, you need business car insurance. This insurance helps you to get extra cover compared to standard car insurance and make sure your car is covered all the time you use it for business purposes. Let’s delve deep into it.

We offer a wide range of Accounting Services, Get in touch to Meet Your Business Needs Beyond Numbers.

What is Business Car Insurance?

Being an employee, if you utilise your car or vehicle as part of your job, you need to buy this insurance. The reasons for using your car for business can be to:

- drive for business meetings

- drive to clients’ premises

- use your car to get to training courses

- give colleagues lifts to anything business-related work

- travel between your company’s different sites/offices

- drive to work-related events/conferences

- using your car to collect or deliver something relating to your job

How it is Different from Commercial & Company Car Insurance?

It is not the same as commercial insurance. Commercial car insurance is for the people who earn from their vehicle or car, like Uber drivers or driving instructors.

If you are given a car by your employer, you don’t need business vehicle insurance. As it is the responsibility of your company to insure the car by company car insurance.

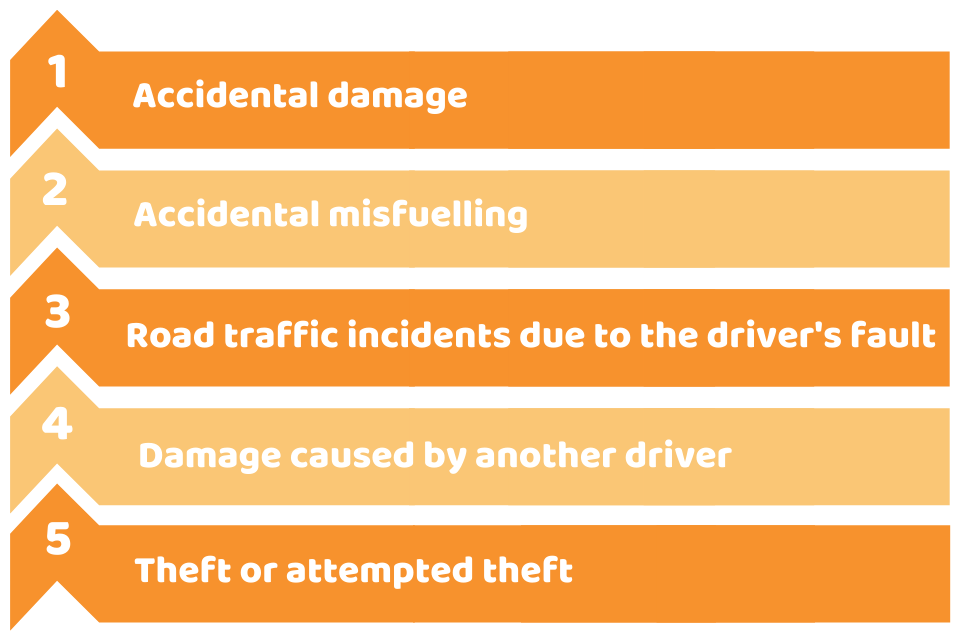

What Does This Insurance Cover?

It varies between your insurer. But typically, it will cover you for:

To get instant help with your business problems, you can contact our accountants available at Accotax and feel free to discuss your business problems!

Do you Need to Have Business Car Insurance?

Yes, if you use your car as a part of your employment, this insurance will cover you for any accident while driving your car for work. But if don’t have this insurance, then you are not eligible to make a claim. There are different classes of this insurance that you need to know:

Class 1

It is the cheapest insurance class that covers your car for commuting to many workplaces or clients (like taking cash to the bank).

Class 2

It offers the same cover as Class 1 insurance but allows you to add a named driver or co-worker who’ll also be insured to drive the car.

Class 3

This class of insurance offers cover for those people who do long-distance driving. It is more costly than the other two classes.

How much does this Insurance Cost?

Using a car for business purposes will cost you more insurance premiums. As people who use their car for business purposes generally drive more miles than others. In addition, this driving is likely to be on busy and unfamiliar roads. It means they are more likely to encounter accidents and, as a result, make insurance claims. So whenever you are most likely to make claim, the cost of insurance cover will increase.

There are different factors involved to work out the cost of this insurance:

- your car model

- the nature of business use

- how many business and social miles the car will do

- who will be the driver

- where you live

- where you park your car overnight

- your claim history and driving record

- your occupation

You need to provide these all details while buying your car insurance for business purposes.

Quick Sum Up

We hope that after giving this blog a read, you have now got a better understanding of business car insurance. If you are employed and use your car for work, you need to have this insurance to claim for the cost against any loss, theft or accident. To save money, you need to buy a car in a low insurance category having security features like an alarm, etc.

Additionally, you also need to be accurate with your annual miles to pay exactly what you need to and should keep a driving license. The number of claims you made in the past also affects your car insurance premium.

Reach out to our certified accountants in London to overcome your financial worries!

Get an instant quote for a customised offer!

Disclaimer: This blog provides general information on the above topic.