If you are a business owner, you need to understand contribution margin to make strategic decisions and to determine the profitability of a specific product. It is the money available to a company from specific revenue to cover its fixed cost and may refer to a single product, multiple products or the total sales. It provides an insight into how much revenue is available to cover fixed costs.

Fixed costs are the costs that are separate from the company’s revenue. These include interest, rent, depreciation, wage costs. On the flip side, variable costs are the costs that change as per the production quantities (raw material and transportation cost).

Find out how our Chartered Virtual Accountants can help you to improve your tax and accounting concerns. Call us at 0203441 1258 or send us an email at [email protected].

Understanding Contribution Margin

It is the difference between the total sales revenue and the variable cost of a company. It is the revenue remaining after deducting the variable costs that are used for the production of products. This margin is specified on a single product, a group of products or sometimes on the total sales. If a company makes a profit from its standard business operations, its margin goes higher than its fixed costs.

How to Calculate Contribution Margin?

If you want to measure the profitability of a product, you need to calculate the contribution margin. All the calculations need to be accurate to know how much a product is profitable. You need to take the following steps to calculate this margin:

- Work out the per unit product price

- Differentiate variable costs from the fixed costs

- Deduct the variable cost from the price of the product

- Pay any fixed cost with this margin

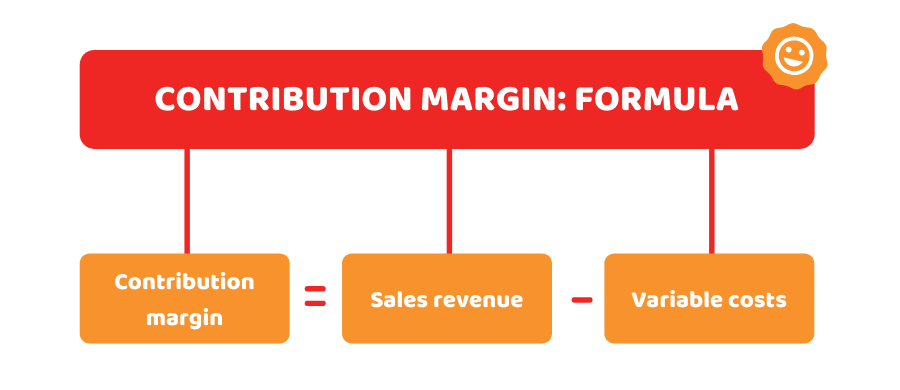

Here is the simple formula to calculate:

Contribution Margin = Net Sales – Variable Costs

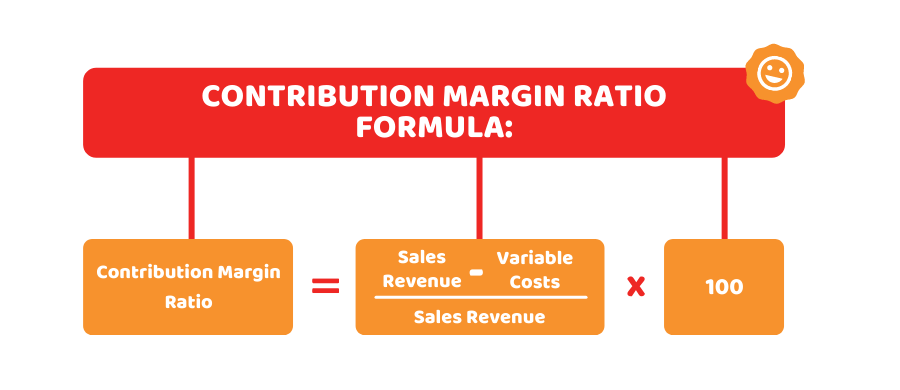

Here is the formula to calculate it in percentage:

Contribution Margin Ratio = ((Sales Revenue – Variable Costs) / Sales Revenue) x 100

Net Sales: It is the total sales minus the returns or allowances. It is the net amount a business expects to receive from its total sales. You can easily find the revenue number on the top of the income statement.

Variable Costs: These are the costs that increase along with the revenue or operations of a company. Like to produce more units of products, more raw material is needed. In this way, the cost incurred on the material will vary based on the level of production. The cost of material will also be determined by the production level. The variable costs include:

- Utilities

- Product supplies

- Shipping cost

- Labour costs

- Production supplies

Find more about improving your revenue with our professionals. Contact us now!

Importance of Contribution Margin

It helps businesses to make multiple decisions. For instance, working out this margin helps you to know which products are doing well and on which you need to focus more. In addition, it also helps you determine whether you need to change the product’s price or stop selling it.

Many people use this margin to compare two products and determine which one is not performing well and contributing much to the overall profit of the company. Once identified, you can decide whether to increase its price or discontinue it to gain money rather than making a loss from its production.

It’ll save a company’s time and money. It is also recommended to consider the fixed costs rather the depending solely on this margin. As the ultimate goal of business owners is to make their products profitable to pay for their fixed costs and other expenses.

How to Improve this Margin?

To improve the margin of contribution, you either need to reduce the variable costs like the cost of shipping or raw material or increase the price of your products or services. Bear in mind that if this margin is lower, your business may struggle to meet its fixed costs. You can improve this margin by reducing the variable costs like you can relocate products to less expensive space or eliminating non-essential positions.

Quick Sum Up

Knowing the exact revenue your business generate helps you to set goals for the company’s growth and expansion. That’s where the contribution margin comes into play to determine the revenue for covering fixed costs. It is the amount remaining after deducting all the variable costs of a business. To improve this margin, variable costs need to be reduced or the product price needs to be increased.

Rely on Accotax to sort out your accounting, tax, payroll and cash flow issues! Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

Disclaimer: This blog is intended to provide general information about the topic.