Whilst focusing on building a company, many business owners neglect the importance of record keeping. No matter your company size or industry you fall in, you need to be on top of keeping business records. It not only helps your company to fulfil its tax and regulatory requirements but is essential for the overall growth of your company. Maintaining accounting and company records yourself can be time-consuming and tricky. So, it is recommended to hire a bookkeeper or accountant to ensure accuracy, reliability, and timeliness.

Let our accountants and bookkeepers handle the hassle of keeping business and accounting records. Call us at 0203441 1258 or send us an email at [email protected].

In today’s post, we’ll be covering what information businesses need to record and for how long these records should be kept. We’ll also discuss how record-keeping saves you from penalties and how it helps with your business’s overall growth. Let’s dive into it!

Keeping Business Records as a Limited Company or an LLP

All the limited companies or limited liability partnerships need to keep and maintain statutory records. These records may be publically inspected at your registered office or SAIL address. Here are the details limited companies must keep:

- Details of directors, shareholders and company secretaries (address, contact information, etc.) present and past

- Details of LLP members (all present and past and address, etc.)

- Directors’ indemnities and service contracts

- Register of PSC

- Records of resolutions and minutes of meetings

- The outcome of any shareholder votes and resolutions

- Loan or mortgage records secured against the LLP’s or company’s assets

- Records of debenture holders

- Transactions when someone purchases shares in the company

- Incorporation certificate

- Contracts relating to the purchase of own shares

- Memorandum and articles of association (MOA, AOA)

- Share certificate and stock transfer forms

Records of People with Significant Control (PSCs) must also be kept. They are people who:

-

-

have more than 25 per cent of shares or voting rights in the company

- can influence or control your company

-

have the right to appoint or remove the majority of the board of directors

-

Note that sometimes you only need a few or full records at your registered office address or SAIL address for inspection. However, you need to keep all records of similar types in a single place and need to tell HMRC at which address you have kept them. You also need to inform Companies House if you have kept the records somewhere else other than the registered office address of the company.

Moreover, you need to keep statutory registers for the life of your LLP or company. Meetings and resolution records must also be kept for at least 10 years.

Looking for someone to help you with record-keeping and overall tax liabilities, Accotax is here to help. Whether you are an LLP or a limited company, be sure to get in touch with us today for a quote!

What Accounting Records Company or an LLP Needs to Keep?

Keeping accurate and up to date, financial and accounting records is essential for limited companies and LLPs, regardless of whether they are actively trading or are dormant. If they do not keep proper accounting records, HMRC can levy a fine of £3,000 on the company or disqualify you as a company director.

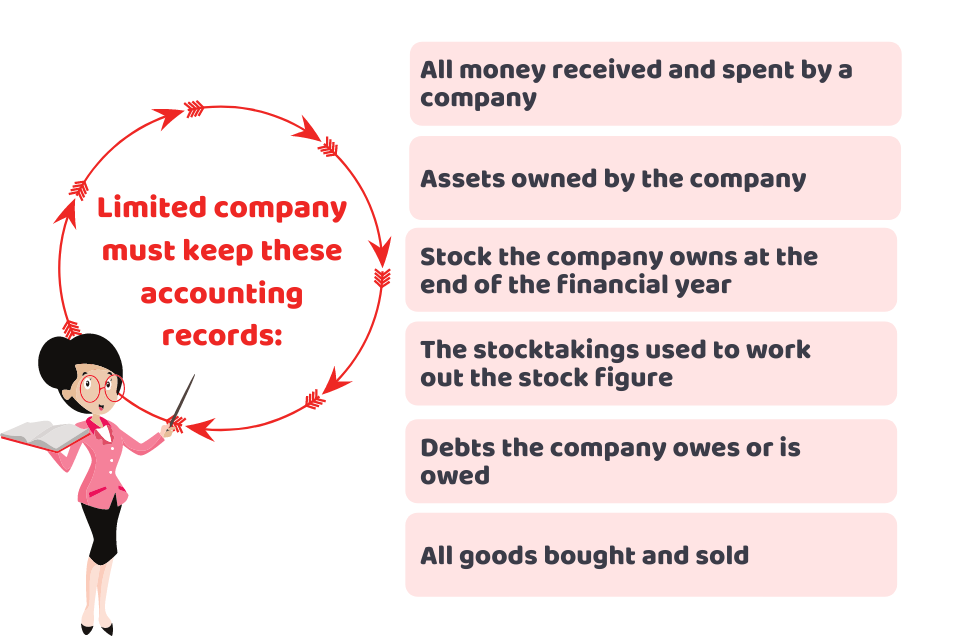

According to HMRC, here are the records that a limited company must keep:

- all money received and spent by a company

- details of the assets owned by the company

- stock the company owns at the end of the financial year

- the stocktakings you used to work out the stock figure

- details of debts the company owes or is owed

- all goods bought and sold and who you bought and sold them to and from (unless you run a retail business)

Also, the company needs to keep other financial records to file its annual accounts and company tax return, which includes:

-

turnover

- profits before other deductions and reliefs

- records of purchases and expenses

-

records of sales and income (including profits, trading losses brought forward, property income)

-

chargeable gains

- VAT records

- tax reliefs and reductions

- PAYE records

- tax reconciliation

-

deductions and reliefs

-

losses

In case, if you have lost the records, they need to be recreated. You must inform your corporation tax office and need to include it in your company returns.

How Long Should These Records be Kept For?

Private companies or LLPs need to keep records at least for three years from the date they are produced. PAYE records must also be retained for 3 years from the end of the tax year they relate. On the other hand, VAT records must be kept for at least six years.

Additionally, contractors in Construction Industry Scheme need to keep CIS records for a minimum of three years. Furthermore, records for completing personal tax returns need to be kept for a minimum of 5 years after the 31st January submission deadline of the relevant tax year.

However, as a general rule, you need to keep all accounting records, financial statements and tax returns for a minimum of six years to be on the safe side.

Quick Sum Up

That’s all about keeping business records for your limited company and LLP. Along with the statutory records, businesses need to be on top of their accounting records to avoid penalties. All the limited companies and LLPs need to implement an effective system in place. In this regard, taking the help of a professional accountant or bookkeeper is recommended to save your time, and hassle so that you can solely focus on running your business.

If you are looking for reliable tax accountants in London that can help your limited company stay on top of its accounting-related needs, Accotax is here to help. Get in touch with us today for a quote!

Have a query? Feel free to reach out!

Disclaimer: This post is just written for informational purposes.