If you’re planning to set up a limited company in the UK, knowing the difference between a registered office address and a business address can be tricky. Many people use them interchangeably, but they serve a different purpose when it comes to the rules of the company address. So in this blog, we’ll explore the differences between the two and what rules you need to follow regarding the use, location and disclosure of these addresses. Let’s have a look!

Establish your own company without any hassle! Allow our limited company accountants to form your company within 3 hours! Get in touch with us today!

Registered Office Address & Business Address – An Overview

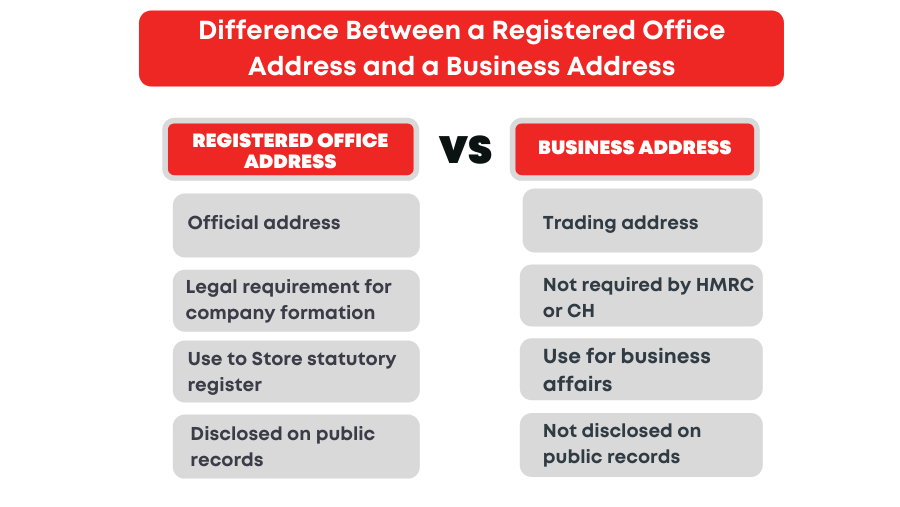

A registered address is a legal requirement for a company that is registered with Companies House and is publically displayed on the register of companies. Limited company owners need this address during the process of company formation. It is the contact address of your company for correspondence with government agencies like HMRC and Companies House. Furthermore, all important posts are received at this location.

A business address also refers to a trading address. This can be a registered address, but it’s not necessary. It is generally the address where a company is located and operates the business affairs from. Moreover, this address is used for correspondence with banks, suppliers and clients. Unlike registered address, it is not required by Companies House and HMRC. In addition, it is not disclosed on public records, unless it serves as a registered office.

Let’s discuss them in detail.

Registered Office Address

This address serves as the official address of the company for legal correspondence between HMRC and Companies House. Here, all legal notices, emails and statutory letters from government bodies like HMRC, Companies House, Department of Work and Pension, Information Commissioner’s Office and Office for National Statistics and Court documents are received.

If you’re a limited company owner or LLPs in the UK, you need a registered office address according to the Companies Act 2006. This rule also applies to those companies that perform online selling or undertake all their business activities outside the UK.

When forming a limited company, a limited company owner or director need to provide a registered office address. This address needs to be a physical address within the UK where a company is registered. This address can be in:

- England and Wales

- Scotland

- Only in Wales

- Northern Ireland

Bear in mind that this address doesn’t essentially need to be the place where you perform your day-to-day business activities. If you meet the legalities of the registered address, you can use the following for it:

- Home Address

- Office of your solicitor or accountant

- Your trading address

- Any other address that is permitted as a registered address

If you want to change your address location being in the same country, you need to update it to Companies House and other official documents that include:

- Emails

- Websites

- Faxes

- Publications

- Order forms

- Invoices

- Bills

- Letterheads

- Receipts

- Cheques

- Money orders

Accotax is an accounting firm that will help your business thrive. Contact us for affordable accounting, taxation, payroll and company formation services!

Business Address

It is primarily the address where business activities take place. Unlike a registered office address, a business address is a corresponding address where a company receives non-statutory mails from clients, banks, suppliers and clients. You can use this business address on your business cards, email, websites, etc.

The communications of a business address do not take place with Companies House, HMRC, Courts and other government bodies. In addition, this address is not displayed in the public records however, it is mentioned on the website of the company website to enable the clients and customers to contact.

Some businesses have just a single business address that can or can’t be the location of their trading activities. And some businesses have more than one business address in multiple countries.

Although a business address is different from a registered address, however, there are many companies that use a single address for both business and registered address. As every business is different, their location also varies as per the business type.

Quick Sum Up

Hopefully, you can now differentiate between registered office address and business address. To sum up, you need to have a registered address as a legal requirement for receiving all legal documents from government agencies whereas a business address is not an official address to correspond with HMRC or CH. In fact, you need a business address to communicate with non-government agencies like clients, banks, and customers. However, you can use your registered address as a business address to perform your daily business operations.

Accotax provides inclusive company formation services with a registered office address in London SM4 or Chelsea at an affordable rate. Click here to get your company formed! If you want to register as a self-employed professional, we’ll register your self-employed business in no time. Fill out this form now and avoid the hassle!

Contact us for queries and help!

Disclaimer: This blog is written to provide general information on the topic.