When you’re going through your business accounts for the first time, you might come across financial jargon like “Pro Rata”. Besides, you might have heard this term while applying for a new job. Usually, the advertised amount of your salary – if it’s not a full-time job – is pro-rata, so it’s one of the important aspects of the job too. Therefore, in this quick blog, we’ll have a look at what is pro rata, how to work out pro-rata salary, wages, holidays, and more.

Looking for Chartered Accountants In London, no need to search further. You’ll surely be in safe hands with Accotax!

What is Pro Rata?

It is a Latin word that means in proportion or proportional rate. In accounting, if you’re given something on a pro-rata basis, it means you are assigned a proportional amount according to the share of the whole. Your pro-rata salary is calculated based on the number of hours you worked.

For instance, if your salary is £20,000 pro-rata in a 40-hour week, but you only worked for 30 hours, you’d get a lesser amount than your salary and it’d be £15,000. So, if you’re working on it, you get a proportion of a full-time salary.

How to Calculate Pro-Rata Salary?

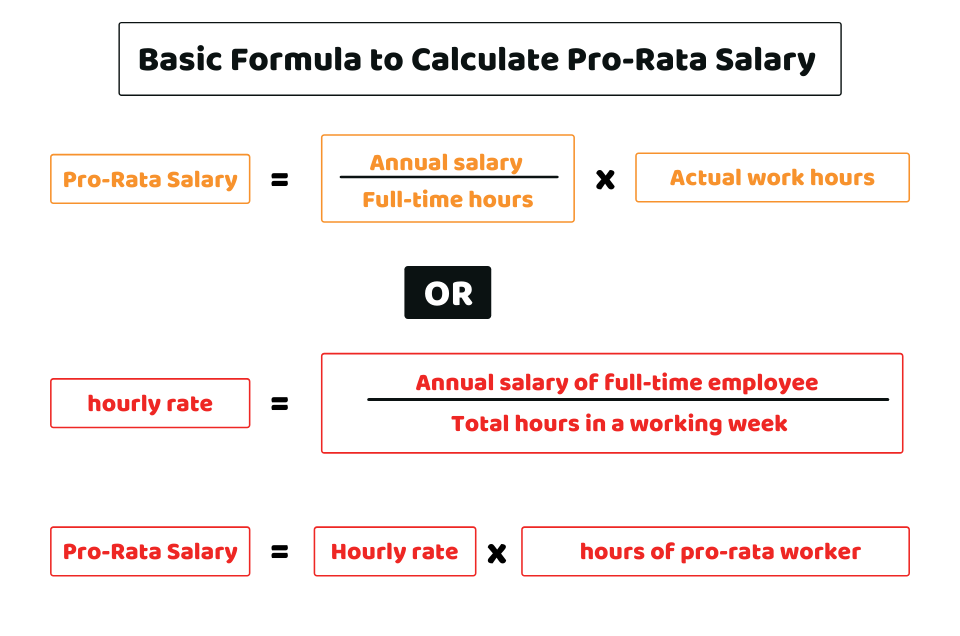

Here is the basic formula to work out your pro-rata salary:

No time to pay heed to these details? Our Accountants will manage it like no one else. Get Instant Help!

How to Calculate Pro-Rata Wage?

Suppose, if you are getting paid £4,000 for a 40-hour week, then you can easily calculate the hourly rate, which is £4,000 / 40 = £100. After getting your hourly rate, you can find out your pro-rata wage by multiplying the hourly rate by the number of hours you’ve worked.

15 hours x £100= £15,00

How to Calculate the Pro Rata Holiday?

If you’re working on this basis, you are also entitled to holidays. So let’s calculate them too. You can easily calculate your pro-rata holiday. To do it, you just need to multiply it by the number of days you work each week by 5.6 (statutory minimum holiday time is 5.6 weeks or 28 days of a full-time employee).

Suppose, if you work for 3 days a week as a pro-rata employee, then your holiday entitlement will be 16.8 days ( 3 x 5.6 ).

Working on a Pro-rata Basis

According to the Part-Time Workers Regulations, part-time workers are going to avail the same perks as full-time workers. It means that if the full-time workers are getting a pension, you also need to provide this to employees working on pro-rata.

If you need a pro-rata holiday calculator online, you can calculate holiday entitlement on gov.uk

Advantages and Disadvantages Of Hiring Employees On Pro-rata Basis

It can help your small business to cut down its payroll cost. Let’s have a look at some of its advantages:

- It saves payroll costs

- Less outgoing on employees’ benefits

- Flexibility during busy periods

Along with these advantages, there are some downsides too that you need to consider:

- Lack of commitment

- Higher turnover rate

- Difficult for team building

Quick Sum Up

We hope that you have got enough information about what is pro-rata and how it is calculated. If you’re an employer or small business owner, taking the services of employees on a pro-rata basis is one of the ideal ways to reduce your payroll cost and save money. However, you need to remember that it has its own limitations and complications. In addition, you need to ensure that you’re properly working out the pro-rata salary, wages, holiday, and benefits to avoid legal troubles.

If you are you looking to hire payroll accountants in London to help you out with your payroll efforts? Accotax has got the solution you need! We have a number of professionals all ready to handle your accounting and payroll concerns. Whether you are a contractor, self-employed, or a limited company, be sure to get in touch with us today for a quote!

Disclaimer: This blog is intended to provide general information on Pro Rata.