Everyone who is associated with the business world and carrying out a business as an owner, we do understand the immense amount of responsibilities that come with the ownership of a business. You still try to owe the last ounce of energy to grow your business and then comes the handling of the liabilities you owe to other individuals as well. However, equity makes it a unique kind of ownership? But do you really understand what is owner’s equity?

There is no need to wonder and worry, we have got you covered with all the answers explained below. Before delving into a detailed discussion, below are the points listed that are important to know all about owner’s equity.

- An Introduction to What is Owner’s Equity

- Owner’s Equity – How to calculate it?

- The Bottom Line

Speak to one of our qualified accountants? Give us a call on 0203 4411 258 or request a callback. We are available from 9:00 am – 05:30 pm Monday to Friday.

An Introduction to What is Owner’s Equity

It may not sound a big deal to carry out a small business as an owner but trust me it is no easy feat to be an owner and operate a company on your own. Let’s first get into a simple detail about equity.

The word equity simply refers to the value of something. Also, when we talk about owner’s equity, it refers to the net worth of the owner’s business. If we deduct all the liabilities from a company’s assets to figure out the exact net worth of the company’s total value, we will get an idea of the owner’s equity to be exact.

Owner’s Equity – How to calculate it?

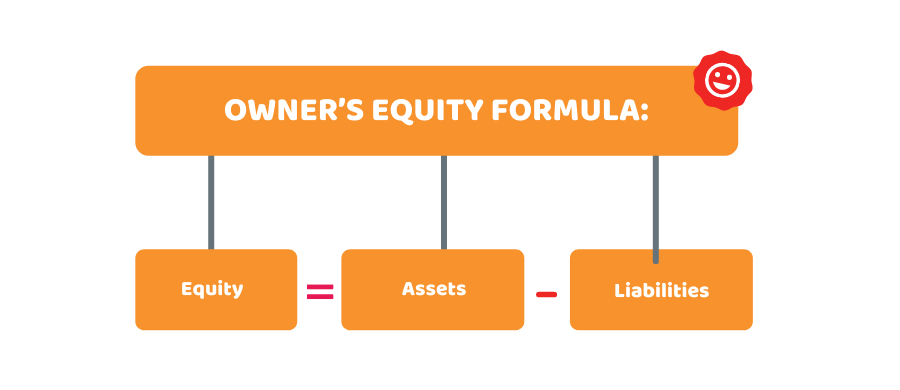

It is important to have an idea of a company’s liabilities and assets in order to calculate a company’s worth or equity. Below is the formula to calculate equity which will make you clear about the required values to calculate owner’s equity.

This can be explained as the liabilities that a company might owe to other businesses or individuals being deducted from the company’s own assets to get the net worth of the company. This is the formula and basic way to calculate the owner’s equity.

The company may have single or multiple owners and the above-mentioned formula can work in both cases.

Moreover, in the balance sheet, the company’s owner’s equity is normally found on the right side as well as the liabilities, however, the company’s assets are found on the other side of the balance sheet. By now you must be wondering about the items that can be included in the owner’s equity other than the ones discussed above.

Some of them are listed in the following:

- Owner’s invested money in their business

- Business profits from the time of the establishment

- Deduct the money that is used by the owner from the business accounts

- The amount of money that is owed to other individuals will also be deducted from this calculation.

Furthermore, there has been confusion about whether shareholder’s equity is defined the same way as we define owner’s equity? There is a difference that can be stated a simple put when a company’s owner is a single individual or a sole proprietor, it is linked with owner’s equity. However, shareholder’s equity refers to the situation in which a company is under the ownership of shareholders or multiple people.

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

The Bottom Line

Now that you have developed a basic understating of what is owner’s equity and how do we calculate it, we can sum up the discussion by saying that it is a well-defined way to clearly know the company’s increases and decreases within its worth. However, it is important to gather accurate information to successfully completion of the calculations.

Accurate analysis of business balance sheets would solve a lot of complications and make it a seamless working process. We hope this few minutes read will help to initiate your process with a clear mind.

Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

Disclaimer: The information provided in this article including text, images, and graphics is general in nature and does not intend to disregard any professional advice.