Statutory accounts are also known as year-end accounts or annual accounts. These are a collection of financial reports prepared at the end of a financial year. If you’re running a limited company (limited liability partnership) in the UK, it is compulsory for you to prepare statutory accounts.

They are used to report the financial activities and progress of a limited company in a tax year. You can also use statutory accounts to find out corporation tax.

The copies of statutory accounts can be sent to the shareholder, companies house, HMRC, and person who attends the general meeting of a company.

Self-employed personnel needs to calculate the profit for the annual tax returns.

Most of companies and businesses provide the task of accounts, tax filings, and tax returns to their accountants. However, directors and self-employed personnel are no exception as they at least have to file accurate information on time.

If you are tired of managing accounts, tax filings, and tax returns, we have a team of certified chartered accountants for your help.

Key Takeaway: While preparing statutory accounts, you should make sure to prepare them as per the regular standards of IFRS or GAAP UK standard.

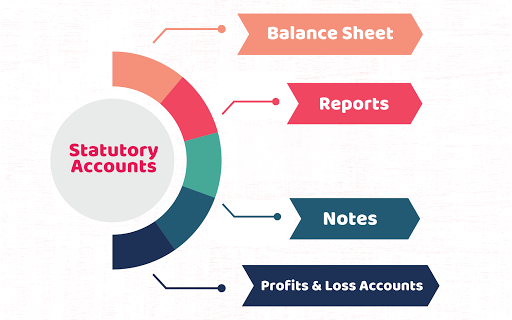

Documents of Statutory Accounts :

A limited company should contain the following documents for statutory accounts:

1. Balance Sheet:

A balance sheet shows the total worth of your company by providing a detailed report of assets, liabilities, and owner’s equity. This statement shows what a company owns, owes, and owed at the end of a financial year.

2. Profit and Loss Statement:

A profit and loss statement is a financial report showing an overview of revenue, expenses, and profit & loss in a tax year.

3. Notes of the Accounts:

These are the supporting notes or documents used with financial statements and final accounts.

4. A Director’s report or an Auditor’s report:

These are the reports signed by the director showing the opinion of the director on the company’s affair. On the other hand, an auditor’s report provides a summary of the audit process and the auditor’s view on financial statements.

Miscellaneous Statutory Filings:

While establishing a business and registering it with HMRC, you should finalize your business status as per the law.

You may also require to register for VAT. Hence, you need to file regular VAT returns on a quarterly basis.

Businesses consisting of employees need to register for PAYE. Employers should make sure to file details while paying their employees. It also includes annual filing details and summaries for the benefits given to the employees.

If a business is a company, you need to provide details of directors and alterations in share capital to the companies house. For surety, you should fulfill an annual confirmation statement to check whether companies house has got your accurate information or not.

Looking for an Accountant:

Statutory accounts can be exhausting and time-taking for the one who doesn’t have an accounting background. A single mistake can ruin your whole record that ultimately leads to penalties. Therefore, you need an accountant.

Accotax has a team of accountants helping small businesses and companies to perform the task of statutory accounts, tax returns, and other filings at an affordable rate. Contact us for an instant response!