Having a child is the most pleasant moment when life takes on a new journey. However, this turn in life comes with new financial liabilities as well. So, the employees and the directors need maternity leaves and advance funding SMP to manage their finances.

In the United Kingdom, businesses are liable to provide Statutory Maternity Pay (SMP) funding to their employees. However, the HMRC comes forward when the small business owners cannot manage to pay their employees, or even directors, from their payroll.

The SMP funding is not as simple as it seems to be due to the cash flow received by the HMRC. Moreover, the application procedure requires you to take precautions to avoid any penalty later.

This article will inform you about everything you can come across while applying for advance funding SMP from HMRC. So, let’s start!

What Is SMP Advance Funding?

SMP advance funding is financial assistance from the employers to their employees or the directors. This is an advance payment of up to 103% of employees’ statutory maternity, paternity, adoption, or shared parental pay.

Sometimes, small business owners cannot pay maternity, paternity, or shared parental pay due to the scarcity of cash flows. They can apply for SMP funding or advance payment from HMRC in this case. The HMRC adjusts the cash flows while repaying these statutory payments in a tax year by managing the PAYE liabilities and the statutory payments to ease the process.

How And When To Apply For Advance Funding?

Although the employers can apply for the SMP themselves, they can also hire the services of an accountant to manage and settle their payments.

Hire the best accounting services in the UK to manage your SMP funding. Contact our team of experts now!

On the other hand, you can also apply yourself. For this, you need to follow the following instruction to avoid any penalties:

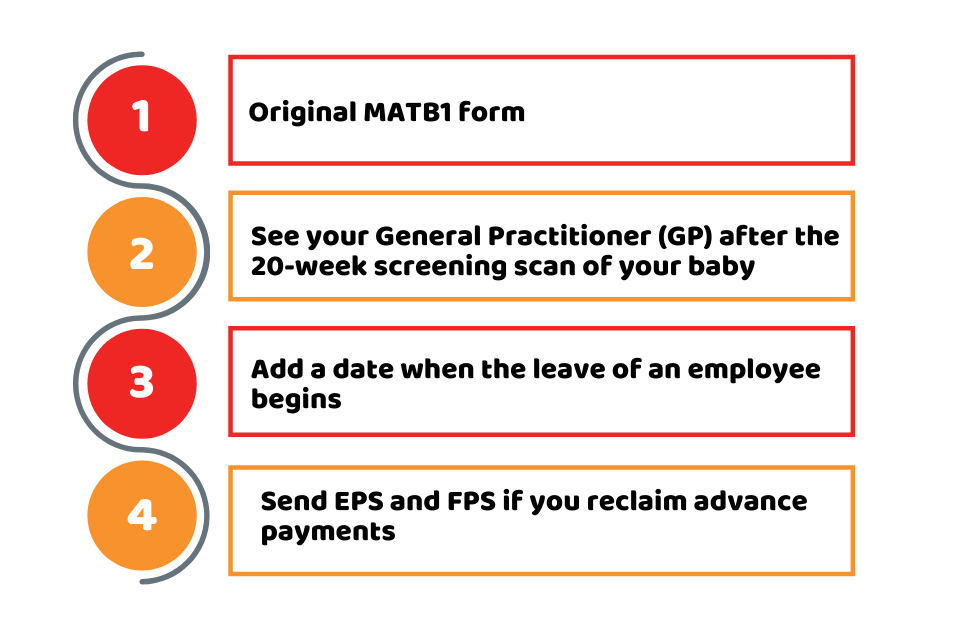

- Original MATB1 form

- See your General Practitioner (GP) after the 20-week screening scan of your baby.

- Add a date when the leave of an employee begins.

- Send Employer Payment Summary (EPS) and Full Payment Submission (FPS) if you reclaim advance payments.

Keep in mind that you must apply for statutory funding before a minimum of four weeks when the payment is due. Otherwise, if you apply before this specified time, HMRC will reject the application.

Besides, if you provide wrong or incorrect information while reclaiming SMP funding, you could be charged as much as £3,000 in this regard.

Statutory Maternity Leave And Pay

The maternity leaves consist of 52 weeks, and this total leaves period breaks down further into two sections.

- Ordinary Maternity Leaves (Initial 26 weeks)

- Additional Maternity Leaves (Remaining 26 weeks)

However, you can apply for maternity leaves 11 weeks before the legal time for leaves begins if you will be a mother. The pay for maternity leaves continues for 39 weeks.

In the first six weeks, the employee or the directors receive payment according to their Average Weekly Earnings (AWE), which becomes 90% of their AWE.

Secondly, the employee receives a standard rate of £151.20 or lower. Depending on the gross earnings, you will get 90% of the AWE in the remaining 33 weeks of maternity leave.

SMP And Taxes

Statutory Maternity Payment (SMP) is categorized as an income and entered into the payroll. So, advance funding will be included in the tax net. Similarly, the employer will deduct the National Insurance contributions from your payment in a tax year.

On the other hand, SMP will be considered a regular income, and your employer may deduct subscription charges, pension contributions, and other such contributions from your pay.

SMP Payments

Once an employee qualifies for statutory maternity pay (SMP), the employer has to pay them the same way a normal wage is paid. However, you will still receive SMP payment if you have left your job. On the other hand, if more than one baby is born, twin or triplets, you will still receive the same amount of your pay as AWE calculations.

Conclusion

Statutory Maternity Payment (SMP) is a relief or assistance for those employees who are going to be blessed with a baby. However, if the employer cannot provide this funding to their employees, they can apply for funding from HMRC.

The employer must apply before the due date, i.e., four weeks. The employee will receive 103% of the employee’s maternity, paternity, or shared parental payment. On the other hand, the employee receives 90% of their AWE advance funding SMP.

We’d be happy to talk to you if you have any questions or require further information. Feel free to contact us!

Disclaimer: The information about advance funding SMP in this article, including graphics, text, and images, is general. This does not necessarily intend to disregard the professional advice.