Losing a family member or a loved one brings emotional and financial trauma. However, the UK government provides a financial benefit in the form of an allowance. For example, if someone is going through some financial difficulties due to the death of their spouse or civil partner, they are eligible to receive a bereavement allowance from the UK government.

However, this financial welfare benefit has undergone some major changes since 2017. As a result, the terms and conditions have been changed accordingly to meet the financial needs of the grieving more effectively.

So, let’s discover everything you need to know about this particular allowance!

Bereavement Allowance

The UK government has merged the bereavement allowance, as previously known, into other contribution allowances and benefits. Before 2017, the deceased family used to claim bereavement allowance as Widow’s Pension.

Get professional tax services in the UK instantly at Accotax. Contact our team!

However, this payment is now a part of the larger pool of bereavement benefits. This group of benefits and allowances is Bereavement Support Payment. This class of new support systems consists of bereavement allowance, Widowed Parent’s Allowance, and Bereavement Payment.

There are no specific income requirements to be eligible for this support income, and people with low or high income can claim this UK government-funded benefit. Similarly, this support payment is available to anyone with or without work or a job.

Who Is Eligible?

The demise of a partner, spouse, or civil partner makes the aggrieved eligible to claim bereavement payment. However, there are certain conditions to become eligible to claim payments if:

- The aggrieved is the husband, wife, or civil partner of the deceased

- The person died on or after 6 April 2017

- Claim within the three months of the death of your partner

- The partner has paid national insurance contributions for six months in one tax year.

- You are under state pension age

- You are a resident of the United Kingdom.

- No particular level of income is required

Bereavement Allowance Benefits

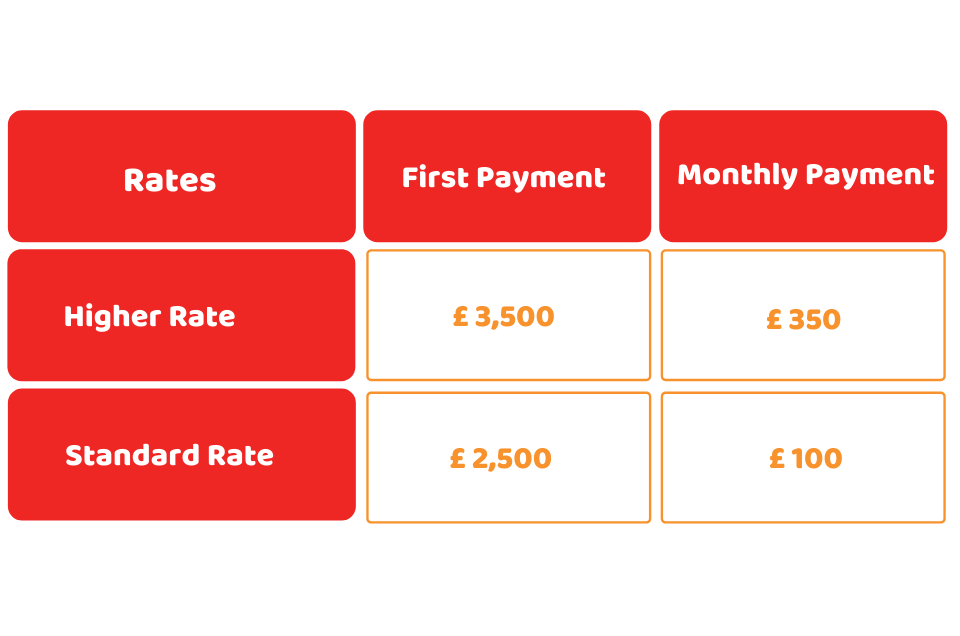

Bereavement Support Payment offers enough financial support to meet the unanticipated costs and expenditures following the loss of a loved one. This allowance consists of two rates.

One is the standard rate, and the other is the higher rate. The standard rate consists of a lump sum payment of £2,500 and then £100 every month for 1.5 years.

You will receive a payment of £3,500 in a lump sum. However, if you receive child benefits, you will receive £350 for 18 months.

Besides, you will receive a monthly payment of £100 for 18 months. If you are receiving child benefits, you will receive a monthly payment of £350 for up to 1.5 years.

How To Claim Bereavement Allowance?

Claiming this exclusive allowance does not consist of complex procedures. However, you must claim Support Payment within three months of the death of your spouse and civil partner. If you delay claiming these allowances and benefits, you will receive fewer and fewer payments.

With every delay, the lump sum amount will become lower. As you can receive benefits for 21 months after the death of your loved one. If you want to claim this allowance you need to download a form of BSP1, fill in and send it to the Bereavement Support Payment.

Conclusion

Finally, we can say that the welfare allowance is a social welfare benefit for the aggrieved who have lost their husband, wife, or a civil partner. No income level or job is required to become eligible for this support income.

But, you should not confuse the bereavement benefit while comparing it with other benefits and allowances. The reason is that it has been amalgamated into the Bereavement Support Payment.

On the other hand, you must claim this income support benefit within three months after the demise of your partner. Otherwise, you will get a lower installments amount if you claim the benefit later. And you will receive an initial payment and then a smaller amount for 18 months.

The payments comprise two payment slabs. The first method is the ‘standard rate’, also known as the lower rate. It is paid with an initial amount of £2500 and then £100 for 18 months.

The other method consists of ‘higher rates’. It consists of the initial payment of £3,500 and then a £350 monthly payment for up to 1.5 years.

Want to know more about bereavement allowance? Seek expert help from our committed team and manage your finances immaculately!

Disclaimer: The information about Bereavement Allowance in this article, including graphics, text, and images, is general. This does not necessarily intend to disregard the professional advice.