If you want to raise a large amount of capital for your new business, one of the great ways to do this is to get funds from venture capitalists. Being mighty investors, they are the in-demand funding source for businesses of multiple sizes, types and industries. Let’s delve deep into what is venture capital? What is a venture capitalist? What are the advantages and disadvantages of venture capitalist? Read on to learn how venture capital can help your startup thrive!

Whether you are a contractor, self-employed, or a small business owner, our experienced ACCOTAX accountants in London have years of experience in financial management and tax calculations. Reach out to us now to get your work done on time. Call us at 020 3441 1258 or send us an email at [email protected]!

Venture capitalists have played an important role in building economies by financing startups for their rapid growth. Big names, like Facebook, Amazon, Apple, Microsoft and many other companies, owe their initial success to the funding and coaching of venture capitalists. Venture capital is a large and better investment option that is difficult to attain.

Curious to know more, keep reading!

What is Venture Capital?

Venture Capital is a form of investment funds (Private equity) and funding source provided by the investors to small businesses and start-ups that are expected to grow exponentially in the future. Additionally, this capital is also provided to emerging companies that are going to expand further. It aims to get back an appealing return against the money invested.

You can get this capital from well off financial bodies: high net worth individuals and investment banks. Aside from monetary funding, it can also be in another form, like training, coaching or teaching expertise. Venture capital is now becoming a common and essential form of investment for small and newly established companies.

What is a Venture Capitalist?

You need to know that venture capital is provided by a venture capitalist. A venture capitalist (VC) provides funding to businesses having a high growth potential against an equity stake. VCs are usually formed as limited partnerships where a partner put money into an investment.

It comprises a committee to make the final investment decision. Once the investment opportunity is determined, an investment is made by the investor with the hope of getting a fairly large return. There are risks of failure due to the uncertain growth prospects of new and small companies.

Bear in mind that VCs don’t offer funds to the business from the start rather, they choose firms that want to commercialize their idea. In short, they search for the best investment opportunity to get the best return.

Accotax offers inclusive financial services for you; we have got you covered with professional accountants, bookkeepers, and tax experts. Get in touch to get instant help!

Advantages and Disadvantages of Venture Capitalist

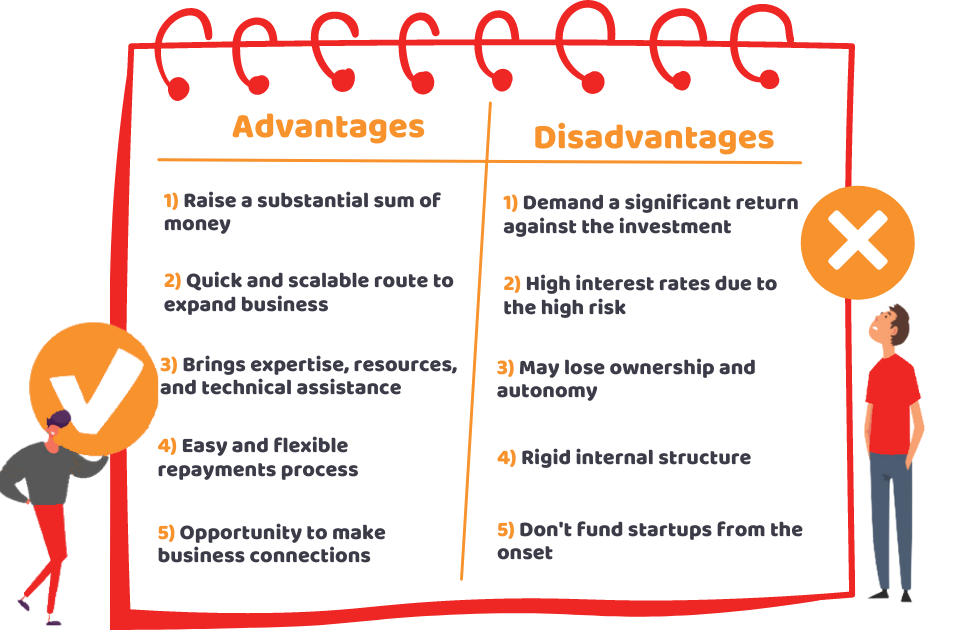

Before getting venture capital from venture capitalists, you need to consider its pros and cons. This option can be beneficial in the following ways:

- To raise a substantial sum of money through equity finances which can’t be achieved through other options

- It is a quick and scalable route to expand a startup and small business

- It brings expertise, resources, valuable information and technical assistance to your company

- You are not legally obliged to make rigorous repayments as like a bank loan

- Opportunity to make business connections

Here are some of the disadvantages of venture capitalists:

- In most cases, they demand a significant return for their investment (from 25% and 50%)

- They often demand high-interest rates due to the high risk

- With too much influence, you can lose ownership and autonomy

- Rigid internal structure

- Typically, they don’t fund startups from the onset

Quick Sum Up

To sum up, you have got a basic overview of what is venture capital? What is a venture capitalist? And what are the advantages and disadvantages of venture capitalists? So, if you are looking for a large sum of capital for your startup or an emerging business, taking funds from a venture capitalist can be an appealing option. However, before considering the option, you need to look at the pitfalls that come along.

No matter you are a self-employed professional, small business, or a large enterprise, our team of financial experts are well versed in optimising your finances. Contact us on 020 3441 1258 or email at [email protected] for queries!

Get an instant quote for a customised offer!

Disclaimer: This blog is written for general information and it should not be taken as expert advice.