Several ways are observed in order to finance a business, as well as there are plenty of ideas through which the businessmen seek the right type of investors for their businesses. This is important to know the value of choosing the right type of finance that can further help to grow your business. There are two ways basically to finance a business and they are listed below:

- Investment Banking

- Corporate Financing

You must be wondering what is investment banking and corporate financing? Companies intend to use these ways to finance their business through different processes. In this article, we will focus on the following discussion points:

- How to Define Corporate Finance?

- Define Investment Banking

- Corporate Financing VS Investment Banking

- The Bottom Line

Speak to one of our qualified accountants if you want to get instant help and get your queries answered quickly. Give us a call on 0203 4411 258 or request a callback.

How to Define Corporate Finance?

The aim of corporate financing is to process the financial business value in such a manner that it increases and ensures maximized benefits for every shareholder. There are multiple banks that have an open option corporate financing for businesses in order to expand them and grow the business valuation. This can help to increase the activity of business operations, new product research, business revenue, and lines of credit.

The level of assistance finance corporation depends on what is the size of a business. Business plans and outstanding debt also matter a lot in this regard.

Let us manage your practice from A to Z. We’ll take care of everything on your behalf while you focus more on your business growth.

Define Investment Banking:

The activity that ensures the capital rais of your company is known as investment banking. This process is possible through the bank. Banks that offer investments to start-ups and current businesses through capital and financing also determine the viability of the investment to make it a safe move. Securities are used to raise such investments by the banks.

Happy with your setup? Let us manage your client. We’ll act as your back office.

Corporate Financing VS Investment Banking:

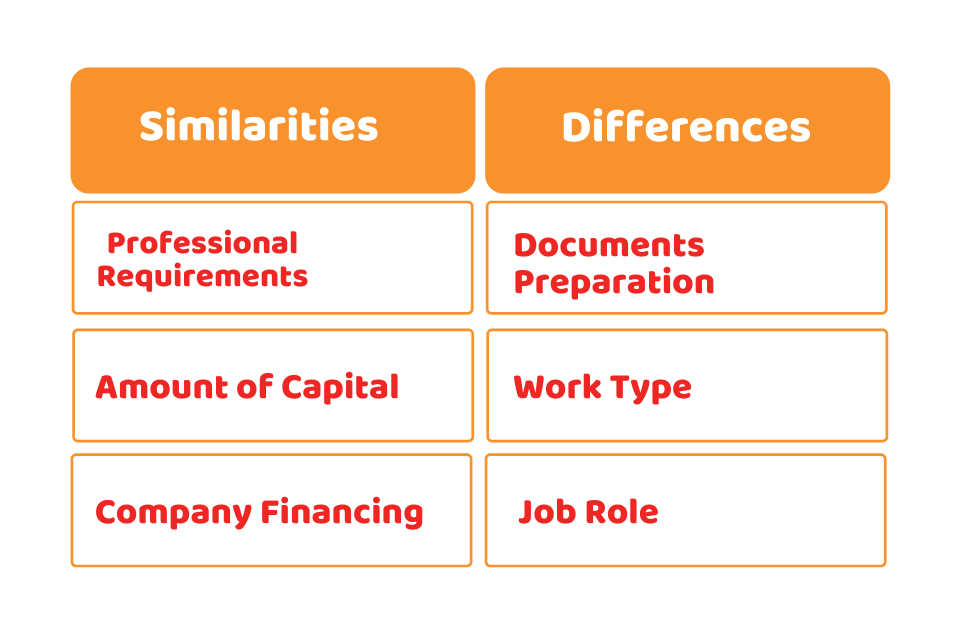

Although investment banking and corporate financing are integral and crucial processes in order to grow and flourish a business, there are some differences and similarities between them even after they serve the same cause.

Similarities:

Let’s first have a look at the listed similarities that are prominent between corporate financing and investment banking:

1. Professional Requirements:

One of the major similarities for both the processes is that they require well-educated and trained professionals in order to ensure seamless working.

2. Amount of Capital:

Capital and substantial amounts are the majorly required factors for both investment banking and corporate financing. However, the terms and conditions may slightly vary in this matter.

3. Company Financing:

Corporate financing and investment banking both aim to provide financial assistance to start-up businesses as well as established businesses.

Differences:

Several key differences between corporate financing and investment banking include the following:

1. Documents Preparation:

Specific documentation is required in both cases, however, work type always differs. Financial reports of the organizations are required in the process of corporate financing by the relevant professionals. The balance sheet is one such example. In the other case, memorandum and pitch books are part of the documentation required by the professionals.

2. Work Type:

If we look into the type of work in both cases, where corporate financing is focused on ensuring the maximization of a company’s worth but investment banking is more into narrowing done the investment needs by hiring highly skilled working staff.

3. Job Role:

Variety of roles is not only is associated with corporate financing, whereas, but limited job roles are also there in investment banking. The reason why investment banking is one of the most competitive niches in the industry is that it requires the most trained, skilled and educated employers to stand out in a unique way.

Give us a call on 0203 4411 258 or request a callback to get professional help. We are available from 9:00 am – 05:30 pm Monday to Friday.

The Bottom Line:

Now that you have developed a better understanding of what is investment banking, we can sum up the discussion by saying that generally both the aspects have same cause but there are more differences than similarities which makes investment banking the most competitive in the industry.

We hope this article helped to provide good knowledge in a clear way!

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

Disclaimer: This article intends to provide general information based on what is investment banking.