When you set up a limited company, the first thing you need to do is to open a limited company bank account. As your limited company is treated as a separate legal entity, you are obliged to open a separate business bank account for your limited company, rather than using your personal bank account for business purposes.

Most startups find it difficult to choose a business bank account, so in this guide, we’ll be talking about the best company bank accounts and the process to open a business bank account. Let’s delve deep into it!

Accotax is an accounting firm that offers inclusive financial services for small business owners, self-employed, landlords, and freelancers at a reasonable price. Give us a call on 0203 4411 258 or request a callback today!

What is the Limited Company Bank Account?

Limited company bank accounts are specifically used by startups and established businesses. Banks usually charge a small monthly or annual service fee. There are some banks that don’t charge a fee for up to two years for new customers and startups.

Business bank accounts work the same as your personal bank account. These accounts can be used for making withdrawals and deposits, using a debit card for purchases and applying for an overdraft. However, unlike a personal account, a business bank account usually charges a fee as per the number of transactions you make. The business transactions include:

- depositing cash

- issuing a cheque

- setting up direct debits

- standing orders

- making a bank transfer

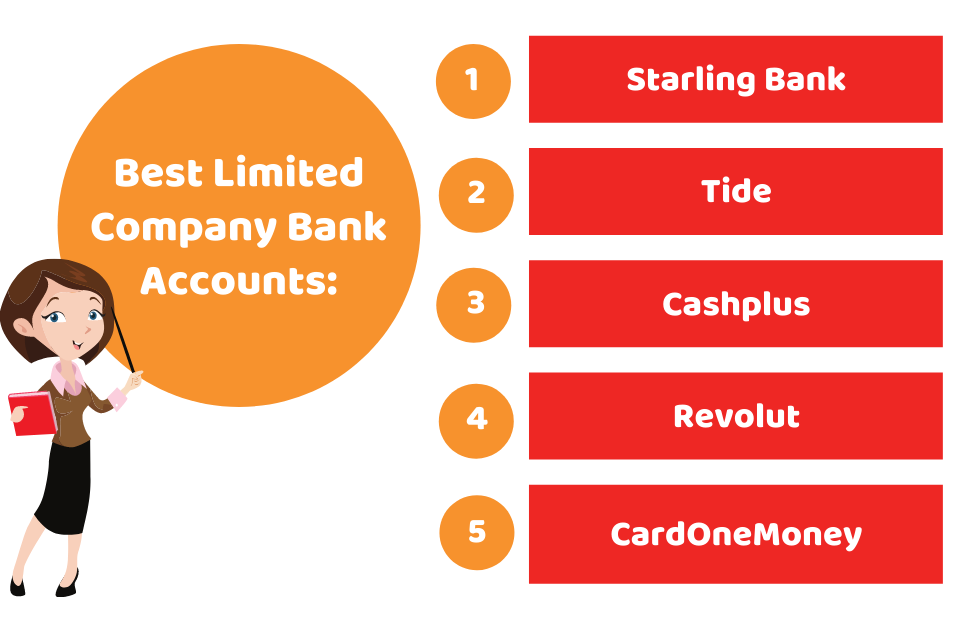

Best Limited Company Bank Accounts

With the numerous bank accounts out there to choose from, it might be difficult to work out the best accounts for businesses. Along with the traditional banks, there are multiple digital and mobile banking apps to choose from as per the circumstances that work best for you. Here is the list of some business bank accounts for limited companies:

1) Starling Bank

It is a digital bank aimed, especially at small businesses, and for those using a limited company for a contracting business. Here, the eligible deposits are protected by FSCS without any monthly fees for international spending. Starling also offers 24/7 UK support and automated accounting services for its customers. It has won various awards. This business banking app can be accessed through desktop browsers.

2) Tide

Tide is a simple digital banking service for UK businesses. By using tide, you can easily transfer cash and integrate it with your accounting software. Here you can make sub-accounts for things like bills, wages and expenses. It is an ideal choice for new businesses as it pays the incorporation fee for new companies.

Learn more: Tide Business Account

3) Cashplus

If you are having a shaky credit history, it is worth using cashplus. It does not credit check. Cashplus offers faster payments, you can connect it with your accounting software. In addition, you’ll also be getting a business expense card and 24/7 access to your account via a Cash plus mobile app.

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

4) Revolut

It’s a digital bank used by businesses to have access to the current account. It is basically managed by a mobile app. With this account, you’d get a start company prepaid debit cards, accounting software integration and round the clock support. Here you can effectively record the expenses through receipts in-app.

5) CardOneMoney

CardOneMoney bank account is yet another business account that doesn’t require a credit check for new applicants, therefore you don’t need to worry if you are having a bad credit history. It contains all the features that normal business accounts offer. It can be accessed via a phone or app.

Like these, other business bank accounts include Clydesdale Bank, RBS, Bank of Scotland, Barclays, Lloyds Bank, Monzo, TSB, Metro and so on.

How to Choose a Business Bank Account?

With the lots of accounts to choose from, you may find it difficult to pick the right one. Most of these accounts have common features, but you need to kick-start the one that best suits your circumstances. Here are the things you need to consider before choosing a business bank account:

- Cost of the bank account

- The method you like to bank

- How good is their online service?

- What are the perks offered by the banks?

- What are the lending terms of the banks?

- What’s the support like?

How to Open a Bank Account?

Firstly you need to provide information to your bank telling who you are. With this information, the bank can carry out your credit and security checks. Then, you need to provide the following details:

- ID, passport or driving license

- Evidence of your personal address (utility bills etc)

- Evidence of the registered business address

- Details of signatories of the account

- Incorporation certificate, and tax & VAT registration details

If you are opening an online account, it only takes around 15 minutes. However, the full process of opening a limited company bank accounts takes around 4 weeks.

Quick Sum Up

Hopefully, you have now understood, what is a limited company bank account, the best business bank accounts, what things to consider while choosing and how to open one. Compare the benefits, features and charges of your bank account before making the final decisions as there are a lot of options to choose from.

Managing the finances of your company is undoubtfully a daunting task, save your time, money and stress and focus on your business growth by allowing us to handle your company finances. We have a team of qualified chartered accountants, bookkeepers and tax experts for your support! Get in touch with us now!

Looking for a customized service, get an instant quote right away!

Disclaimer: This blog is intended for general information on company bank accounts.