Free cash flow (FCF) is one of the effective metrics to get a closer view of the company’s financial condition. Best investors don’t waste their time looking at the company’s profit. Instead, they utilise a lot of time looking at its free cash flow to work out whether or not a company’s shares are worth the money they invest. So, free cash flow is a helpful way to differentiate between a good and a bad investment. By the end of this blog, you’ll learn; what is free cash flow, how to calculate it, how to use it and what are its benefits?

Let’s dive in!

Find out how our Chartered Accountants can help you to improve your business cash flow. Call us at 0203441 1258 or send us an email at [email protected]. Contact us now!

What is Free Cash Flow (FCF)?

To put it simply, FCF is the money left after paying the capital expenditures and operating expenses (like real estate, machinery, equipment, etc). In other words, it is the company’s cash profit that can be spent on whatever things it wants.

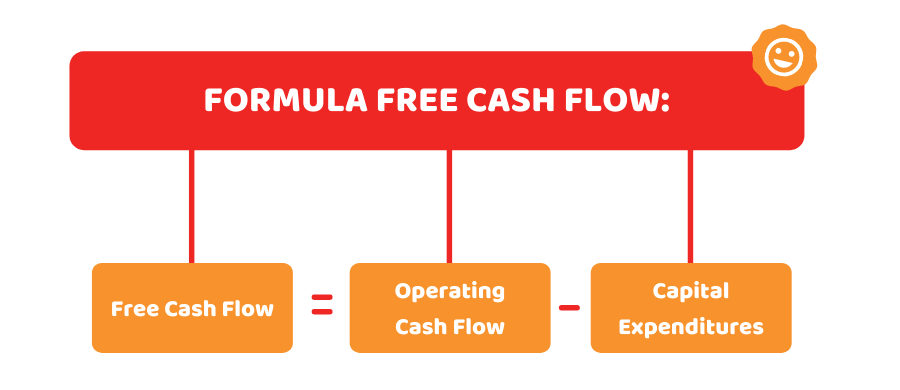

How to Calculate FCF?

To calculate FCF, first, you need to find out the operating cash flow. Here is the formula to calculate operating cash flow:

Operating Cash Flow = Net Income + Non-Cash Items + Changes in Working Capital

Where:

- Net Income: Money left after paying expenses

- Non-cash items: It includes depreciation, amortisation, loss/gains on investment, stock-based compensation, etc

- Changes in working capital: Difference in your annual net working capital

After working out operating cash flow, you can calculate FCF, with this simple formula:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

Note that there is no standard way to calculate the FCF. However, it can be divided into two types through which you can better understand its use:

1) Free Cash Flow for Firm (FCFF)

FCFF refers to the money left over to make payments to its lenders (interest) and shareholders (investors) after making payments, like business costs, current and long term assets. By calculating FCFF, you would be able to know the company’s operations and performance. In a nutshell, all leftovers after conducting the business operations show the free cash flow for a firm.

Here is the formula to work out FCFF:

FCFF=NI+NC+(I×(1−TR))−LI−IWC

where:

- NI=Net income

- NC=Non-cash charges

- I=Interest

- TR=Tax Rate

- LI=Long-term Investments

- IWC=Investments in Working Capital

2) Free Cash Flow for Equity

It helps you to know, how much cash is available to the equity shareholders of the company after all expenses, reinvestment and debts are paid. Investors need to pay attention to this amount. So, it can be a good indicator to know how a company generates free cash flow, but it might be of no use if calculated separately.

Here is the formula to calculate:

FCFE=Cash from operations−Capex+Net debt issued

Here Capex stands for capital expenditures.

If you have got all the relevant information in hand, you can easily calculate FCF.

Accotax offers a full range of accounting and bookkeeping services to our clients. Give us a call on 02034411 258 or request a callback today.

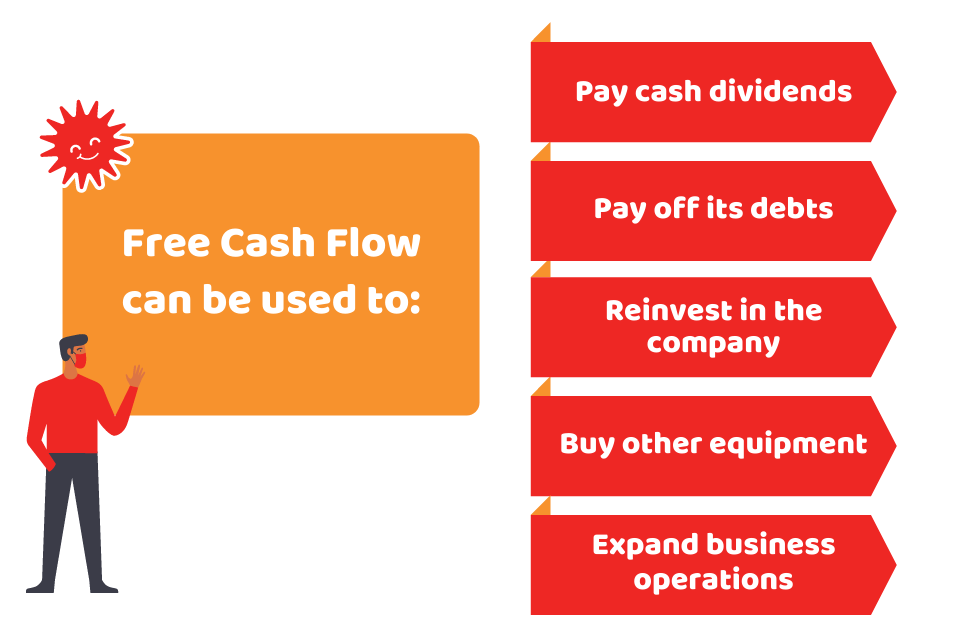

How to Use Free Cash Flow?

Once you have understood what is free cash flow and how it is calculated, you need to determine where and how to use FCF. As these are the funds remaining after accounting for cash outflows to support operations and maintain capital expenditures. The decision to use these funds may be critical for long-term business success.

The capital allocation is also determined as per the free cash flow available and how frequently a company generates it. Here are some of the uses of FCF:

- To repurchase its own shares

- For paying cash dividends

- For paying off its debts

- To reinvest in the Company

- For buying other equipment

- For expanding business to make more money

Benefits of Free Cash Flow

There are many benefits of working out free cash flow. Most importantly, it provides valuable information about the financial fundamentals of your business as it is a complex figure to calculate and use, compared to net income. Additionally, it helps lenders and investors to gauge the probability that a company would earn enough to pay its expected interests and dividends.

Summing Up

We hope that you have found something of value for your investing journey by learning about what is free cash flow, its types, formula and how to use it. Although it is an important financial metric, however, it is not utilised by investors as it should be. So investors should also apply other financial metrics to get a closer look into the financial condition of a business. And they should not solely and exclusively depend on FCF to gauge whether or not a company is worthy of investment. FCF along with other metrics would be better to get a broader view of the company’s financial position.

Let Accotax handle your cash flow issues! Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

Disclaimer: This blog is intended to provide general information about free cash flow.