If someone is working for your business, you need to comply with the standard terms of employment law. Many business owners may face confusion to differentiate whether the person is an employee or contractor. According to the employment law, as an employer, you need to comply with the legal duties and have responsibilities to follow. So, it’s crucial to understand employee vs contractor: differences. In this post, you’ll also learn the advantages and disadvantages of hiring contractors and employees.

Let’s dive in!

Find out how our Chartered Accountants can help you to improve your tax and accounting concerns. Call us at 0203441 1258 or send us an email at [email protected]. Contact us now!

Employee vs Contractor: Differences

Employees and contractors have different employment statuses, rights, and duties. They are not taxed the same. Employees have a permanent position in a business. The company provides them with the tasks and they offer their services to the business under employment rights.

On the other hand, the contractors generally work temporarily and have less rights, but more control over their time, place, nature, and cost of work. They can work on several projects simultaneously.

Here are the major differences you need to be aware of:

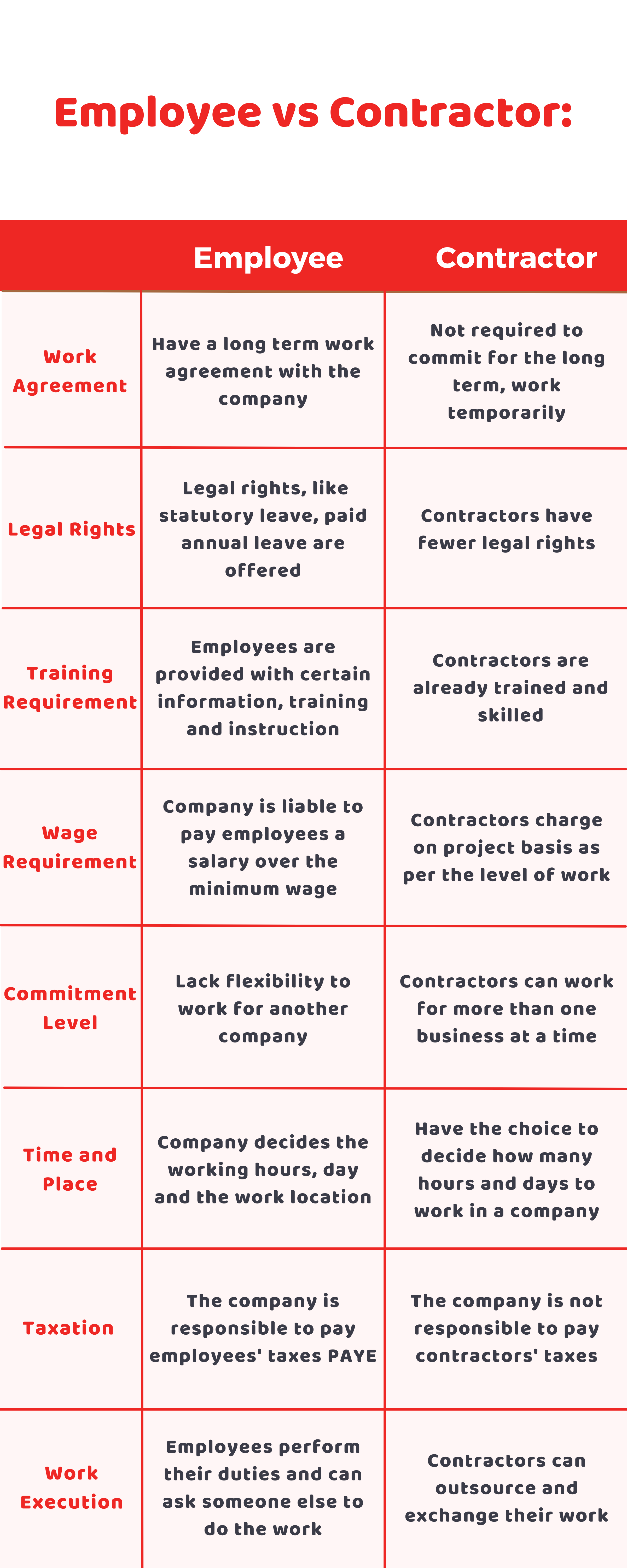

1) Work Agreement

Generally, employees have a long-term work agreement with the company and they must perform work received regularly. Whereas, contractors are not required to commit for the long term. They have the choice to accept or reject the request of the companies.

2) Legal Rights

Employees enjoy the benefits of legal rights, like statutory leave, paid annual leave, time off for emergencies, minimum notice period, redundancy pay, etc. On the other hand, contractors have fewer legal rights, but companies must comply with health, safety, and data protection laws.

3) Training Requirement

Employees are provided with certain information, training, and instruction. Employees also need to comply with the organisational procedures. However contractors, typically, are already trained so they can work independently.

4) Wage Requirement

Companies pay their employees a salary over the minimum wage. Whereas, contractors do not work on a salary basis. They charge money on a project basis for their job as per the level or complexity of the work.

4) Job Role

The job role and duties performed by an employee are set by a company. On the flip side, contractors can decide their job roles as per their wishes. They can choose to do the type of work they want and reject the one that doesn’t suit them.

5) Commitment Level

Contractors can work for more than one business at a time and they can also outsource the work in their own industry, whereas employees don’t have the flexibility to work for another company.

6) Timings and Place

The company decides the working hours, day, and the work location of employees. Contractors have the choice to decide how many hours and days to work in a company. As stated, they have the control to accept and deny work and have control of the location to work.

7) Taxation

The company has the responsibility to pay taxes of the employee through the Pay As You Earn (PAYE) system. On the other hand, those companies taking the services of the contractors are not responsible for paying the contractors’ taxes. The contractors themselves pay and handle their taxes.

Accotax offers a full range of accounting, bookkeeping, payroll, and tax services. Give us a call on 02034411 258 or request a callback today.

8) Work Execution

Employees need to perform their day-to-day duties and task themselves, they can’t ask someone else to do the work on their behalf. On the other hand, contractors can outsource and exchange their work. They can ask their subordinates to do their work.

After going through these differences, you have understood that the responsibilities of an employer differ based on the persons they work with, in many ways. However, some legal duties, like health and safety apply to both.

Advantages & Disadvantages of Hiring Employees

Here are some of the common advantages of hiring employees:

- An employer has greater control over employees

- A greater understanding of the organisation

- Commitment

- Standards are set by the employer

- Loyalty to the business

- Consistency for customers

- Greater teamwork and collaboration

Here are some of the downsides of hiring employees:

- Employees have a lot of employment rights compared to the contractors

- They’re not cheap as they’re going to be paid on an hourly basis

- Commitment to fulfil by an employer, like salary, paid leaves, bonuses, etc

Advantages & Disadvantages of Hiring Contractors

There are many advantages of hiring a contractor. These include:

- Contractors have a specialised set of skillset

- Less HR admin

- Good for urgent and temporary tasks

- Flexibility

- Minimise the risk of inappropriate hire

- Less legal obligations for the employer

- Competitive advantage

The disadvantages of working with contractors include:

- Less control

- Uncertainty

- Lack of loyalty

- Issues regarding copyrights and intellectual property

Quick Sum Up

So, you have now understood the employee vs contractor: differences. They vary to a great extent as per the employment laws, legal rights, job roles, and tax implications. Many businesses owners want to avoid the extra costs and HR admin to hire full-time employees, but they forgo the long-term benefits of collaboration and teamwork. Therefore, you need to think about your situation to determine what’s best for you.

In case that, having perused the above-mentioned, handling everything without help from anyone else is still excessively overwhelming – don’t be put off. Here at Accotax, our payroll service removes the cerebral pain from being a business owner.

Looking for a customized service, get an instant quote right away!

Disclaimer: This blog is intended to provide general information about the topic.