In today’s blog, we’ll be discussing: what is a P11D, what is a P11D (b), what things need and needn’t be included in it, when you are required to file it, and P11D deadlines & penalties for late filings. At the end of this guide, you’ll get a better understanding of how to declare benefits in kind to HMRC annually. Let’s explore!

Find out how our Chartered Accountants can help you to improve your tax and accounting concerns. Call us at 0203441 1258 or send us an email at [email protected]!

What is a P11D Form?

P11D is a form or document used by employers to report HMRC about certain benefits in kind, expenses and facilities paid or given to employees or directors to pay tax on. Employers issue this form at the end of each tax year. This statutory form is required by the tax office to show the amount of your year-end expenses, also known as company benefits.

The P11D form allows employers to tell the worth of employment benefits to HMRC on the annual Self-Assessment return. As company benefits increase employees’ salaries, so they may be liable for NICs on them. However, bear in mind that NICs will be paid by the company, not the individual.

What is P11D (b) Form?

It is a form that employers must submit. It summarises how much Class 1A National Insurance employers need to pay for all the expenses and benefits they’ve provided. You must submit P11D (b) if:

- you have submitted any P11D forms

- you’ve made payments to employees’ expenses or benefits via payroll

- HMRC has asked you to, either by sending you a form or email

You need to complete a declaration telling HMRC that you don’t owe Class 1A National Insurance if you are asked by HMRC to submit P11D (b) form.

What Things Need and Needn’t be Included in P11D form?

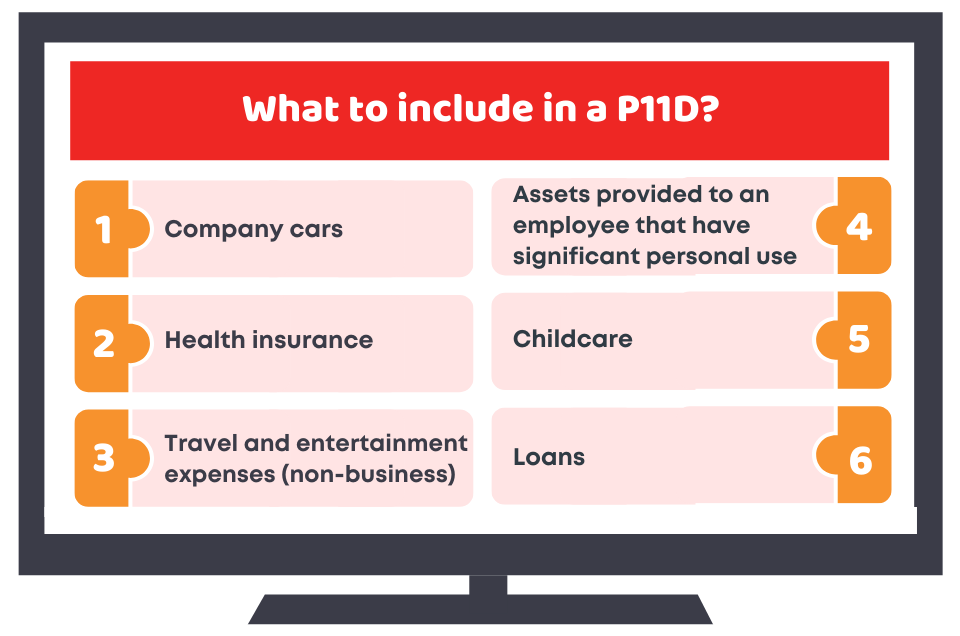

Any items, benefits or expenses paid and reported to HMRC by the company other than the salary need to be included on P11D form. These include:

- Company cars

- health insurance

- childcare

- loans

- travel and entertainment expenses (non-business)

- assets provided to an employee that have significant personal use

As of 6th April 2016, employer dispensations – where expenses could be omitted from P11D forms – have been replaced by an exemption. These allowable business expenses don’t need to be reported in a P11D form. These expenses (exempt) include:

- Business entertainment expenses

- Fees and subscriptions

- Business Travel

- Credit cards used for business purposes

When do I Need to File P11D?

Filing the P11D form is one of the employers’ year-end duties. This form must be filed by 6th July following the end of the tax year on 5th April. So, for the year 6th April 2021 to 5th April 2022, this form must be filed by 6th July 2022.

Need help with filing the P11D form? Rely on ACCOTAX. Give us a call on 02034411258 or request a callback to do the hassle on your behalf!

P11D Deadlines and Late Filing Penalties

Forms P11D and P11D(b) should be filed by the 6th of July following the tax year. The P11D late filing penalty is similar to those issued for the late filing of the employer annual return. You’re given about two weeks more to file them after 6th July. If not submitted after two weeks, a penalty of £100 is issued per month or part month the return is late, for every 50 employees.

Additionally, if there’s a deliberate or careless mistake in the form, you could be charged a penalty. Plus, penalties and interest might be incurred, if you make the payments late.

Need Help!

Hopefully, this guide on what is a P11D form helps you out with your year-end reporting of company benefits to HMRC. Filing the P11D form can be daunting if you don’t have in-depth knowledge. To be on the safe side, you need to keep records of all the expenses and benefits you provide to the employees or directors. It will allow you to effectively fill out this form without much trouble.

Need help filing your P11D form? We’re here to help. Our accountants and tax expert will guide you with every part of your personal and company tax filings. Give us a call on 0203 4411 258 or request a callback.

Get an instant quote based on your requirement now!

Disclaimer: This blog is intended to provide general information and should not be taken as expert advice.