As a registered company owner in the UK, you need to submit your annual return to Companies House every year. In this post, we will go over what is an annual return, what information you need, how to submit and what penalties may incur in case of its late submission.

Meet your business needs beyond numbers with Accotax, contact us now!

Let’s kick off with what is an annual return.

What is an Annual Return?

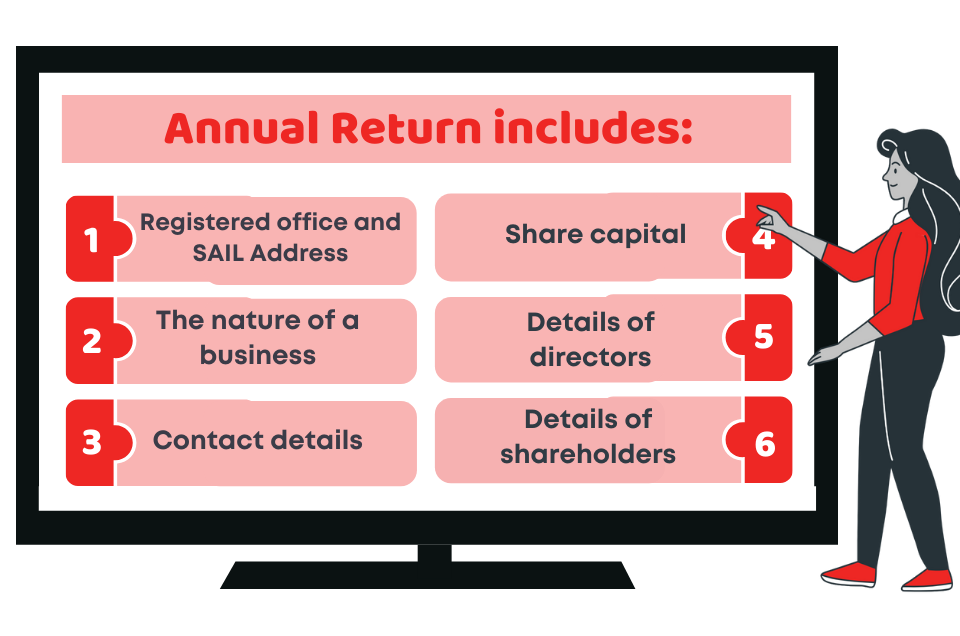

Your annual return is a document that provides a summary of your company’s general information that includes:

- Your registered office and SAIL Address

- The nature of a business

- Contact details

- Share capital

- Details of directors

- Details of shareholders

Your annual return – as evident by the name – must be filed to Companies House on annual basis. The minimum time to submit your annual return is 12 months, however, you can also return your information more than once within this time.

In this way, it is useful to update the company information without worrying about its deadline. To avoid the delay, you can file the most current company information first. Then, you can make a new return to Companies House about the changes or updates to provide accurate and up-to-date information.

Remember, don’t mix up your annual returns with your tax return and the annual accounts of your company. They’re not the same and you don’t need to file them at the same time.

Information that I Need to Include in my Annual Return

You must include the following information in your annual return:

- Contact details of your company: registered addressed and single alternative inspection location (SAIL) – the address to store records if there’s no other address.

- Information about the directors and company secretary (if there is one) like their name, address, date of birth, etc.

- Information about the major business activity. You have to select your major business activity from the list of standard industrial classification (SIC) codes to explain what business your company performs.

- The type of company you have (like a public or private) and the shares that it issues. In some stances, you also need to provide details of your shareholders.

Whether you are just starting out or a veteran, you need to get expert financial advice from our Chartered Accountants to grow your business. Get in touch today!

How Can I Submit my Annual Return?

The simplest and most convenient method to file/submit your annual tax return is to do it online through the Companies House WebFiling service. It will cost you around £13 and you can pay it via credit card or PayPal.

Here, you need to note that before getting this service, you first need to register with the Companies House WebFiling service. Afterwards, to confirm your registration, the Companies House will send you an authentication code at your company’s address.

In addition, you can also file your return by the traditional postal service. This will cost you £40 to file your return by post. For it, you just need to download the annual return form (AR01) with a cheque and send this form to Companies House. While submitting a cheque, you should write your company number on the back of it.

When Do I Need to Submit my Annual Return?

Companies House will either send you an email alert or a reminder to your business address in case if you have crossed the deadline of the annual return. Typically, this deadline is after one year of registration or a year after the date you filed your last annual return. Note that your annual return needs to be filed within 28 days after the due date otherwise you’d be charged with a penalty.

Penalties for Late Submissions or Non-filings of Annual Return

If you submit your annual return late or didn’t file them, you may be levied a penalty of around £5,000. Also, there can be legal action against the company and its directors. If this gets worse, your company could also be struck off.

Take your Business to the Next Level with Accotax

We know that you’re busy with your business and have no time to handle company accounts, taxes and reports. Let us do that! Accotax is one of the UK’s leading accountancy firms with a team of qualified bookkeepers, chartered accountants and tax experts. We take care of your overall business finances and provide you with expert insight to take your business to the next level.

We offer inclusive financial services for small business owners, self-employed, landlords and freelancers at a reasonable price. If you’re the one, you may contact us today!

Disclaimer: This blog is intended to provide general information on annual returns.