Whenever you buy or transfer a residential property, you need to pay stamp duty on it. But is there any Stamp Duty on a commercial property like offices, shops and work units? The answer is obviously, Yes.

In fact, the Stamp Duty is a one-time tax that is applicable on all property transactions above the threshold of £150,000. Although, the amount of stamp duty you pay depends on different factors like lease term and purchase price. This can be complex. To make things easy this post will help you to get a deep insight into stamp duty on commercial property.

Save your time, money and stress by allowing us to manage your taxes including Stamp Duty Land Tax. Accotax has a team of tax experts to save your pennies against unwanted taxes. Contact us right now!

What is Stamp Duty Land Tax?

SDLT is payable on all land and property transactions in the UK, including commercial properties if:

- you buy a freehold property or new/existing leasehold

- you purchase a property through a shared ownership scheme

- your land or property are transferred against payment like you get a share in a house

How Much SDLT is on Commercial Property Purchases?

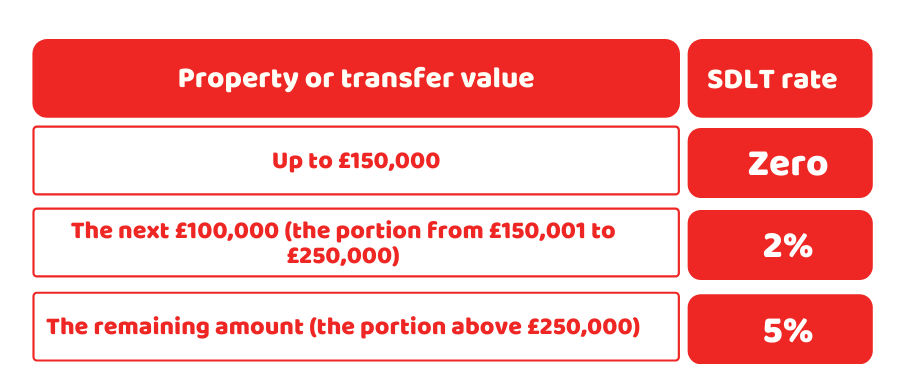

Whenever you purchase a commercial property, the amount you pay as Stamp Duty is worked out based on the purchase price of the land or property on a sliding scale. The rates of SDLT applicable to commercial properties are as follows:

- If you made a purchase of up to £150,000, you don’t need to pay any SDLT

- The amount of purchase from £150,001 to £250,000 charges a rate of 2%

- For purchases above £250,000, you need to pay 5% SDLT

These rules are only applicable in England and Northern Ireland. In Scotland, the SDLT is known as land and building transaction tax. And in Wales, it is called land transaction tax.

Example:

Let’s say you purchased a commercial property at £300,000. To calculate SDLT, you can follow the steps below:

- First £150,000 at 0%: £150,000 x 0% = £0

- Next £100,000 at 2%: £100,000 x 2% = £2,000

- Remaining £50,000 at 5%: £50,000 x 5% = £2,500

Total SDLT that you ned to pay: £0 + £2,000 + £2,500 = £4,500

It is better to consult our accountants before making a property purchase! Get in touch now!

Stamp Duty Land Tax for Leasehold Commercial Properties

SDLT is also applicable on commercial properties leases in the UK above a certain threshold. When you lease a commercial property, your SDLT will depend on the net present value (NPV). Here are the SDLT rates for commercial properties that are on lease.

| Net Present Value | SDLT rate |

|---|---|

| Below £150,000 | 0% |

| From £150,001 to £5,000,000 | 1% |

Note: If your net present value exceeded £5,000,000, you have to pay SDLT at the rate of 2%.

Exemptions

Other than the transactions under 0% rate bands, you can also get exemptions on SDLT in a few other circumstances. If you get a commercial property lease of more than seven years under the £40,000 premium and if its annual rent is below £1,000 in such case you don’t need to pay any SDLT.

Moreover, you can avoid SDLT if you purchase a commercial property below £40,000. In addition, the stamp duty land tax is not payable on a property left in a will including those having an outstanding debt.

SDLT Reliefs

You can reduce your SDLT rate to a great extent by using these SDLT reliefs.

- Property transfer between companies

- Charities Relief

SDLT Deadlines and Penalties

You need to make sure that your SDLT return is submitted and paid within a month after the completion of a commercial property transaction. If you fail to do so, you’d be charged with a penalty. The penalty amount would depend on the late payment duration. Here are the penalties for late payment of SDLT:

- SDLT that are late up to 12 months would be charged with 10% of the SDLT amount (maximum of £300 penalty)

- If your SDLT is late from 12 to 24 months, you would be charged 20% of the SDLT amount

- If it exceeds more than 24 months, then you have to pay 30% of the SDLT amount

Quick Wrap Up

To conclude, we can say that you need to pay stamp duty on a commercial property if your property transactions cross the threshold of over £150,000. Moreover, you also need to pay SDLT on leasehold commercial property. Along with the reliefs, there are many things you can do to reduce your SDLT bill. For example, you can remove furniture and fixtures during a property transaction to mitigate your SDLT bill. Like this, there are many ways through which you can reduce your stamp duty.

Want to reduce your SDLT, reach out to us right away! We offer inclusive financial services for small business owners, self-employed, landlords and freelancers at a reasonable price. You may contact us today!

Disclaimer: This post is written for general information on SDLT.