How much is Stamp duty on second home and how to avoid it? This question is asked by many people whilst buying a second home in England or Northern Ireland. Bear in mind that you need to pay this tax, no matter you are buying a holiday home, buy-to-let, freehold, or leasehold property. In this post, we’ll explore:

- What is Stamp Duty?

- How much is Stamp Duty?

- Stamp Duty on Second Home

- How much is Stamp Duty on Second Home?

- Ways to avoid or reduce SDLT on a second home

Save your time, money, and stress by allowing us to manage your taxes, including Stamp Duty Land Tax. Accotax has a team of tax experts to save your pennies against unwanted taxes. Contact us right now!

What is Stamp Duty?

Stamp Duty Land Tax (SDLT) is a tax that you need to pay when you buy a residential property or land in England or Northern Ireland over a threshold of £125,000 ( for residential property) and £150,000 (for a non-residential property).

If you’re a first-time buyer, you are not required to pay SDLT on the property worth up to £300,000. Over this amount from £300,001 to £500,000, you just need to pay SDLT at a discounted rate of 5%. However, over this, you are not eligible for this relief (discount).

If you want to buy a home as a second home, you need to pay an extra 3% SDLT on the properties costing over £40,000. This tax is applied to almost all types of properties.

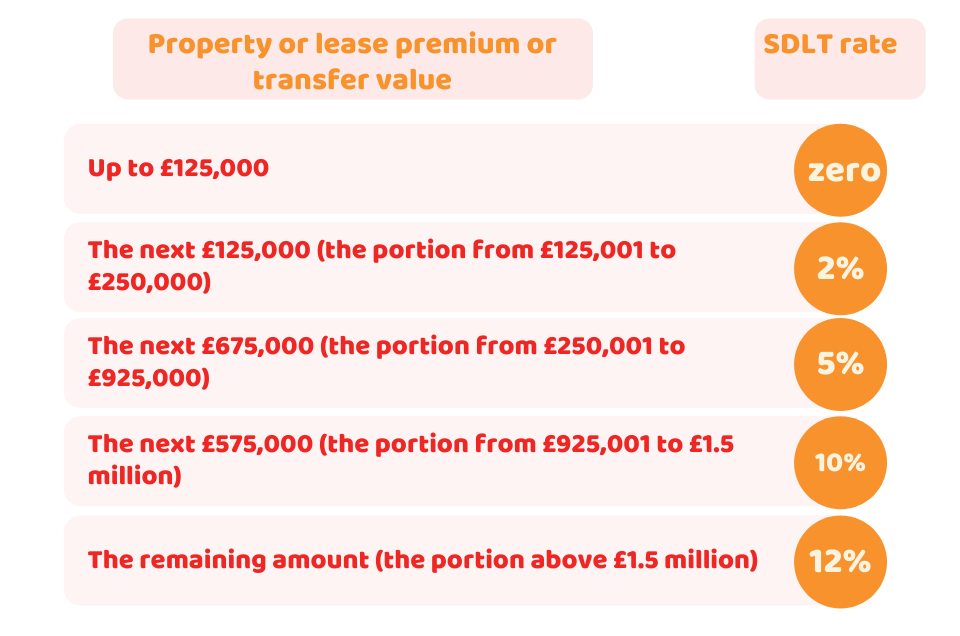

How Much is Stamp Duty?

There are different rates of SDLT, which are calculated based on the price of property falling within each band. Here is the table to know the Stamp Duty tax rates for residential property as of 2021-22.

Stamp Duty on Second Home

You are required to pay SDLT at a higher rate when you buy a residential property or a part of one for £40,000 or more if all these conditions apply:

- It won’t be your only residential property worth £40,000 or more that you own

- You haven’t given away or sold your previous main home

- No one else has a lease on it and has over 21 years left to run

If you own or part over one residential property worth up to £40,000 or more, you need to pay higher rates on your additional purchases.

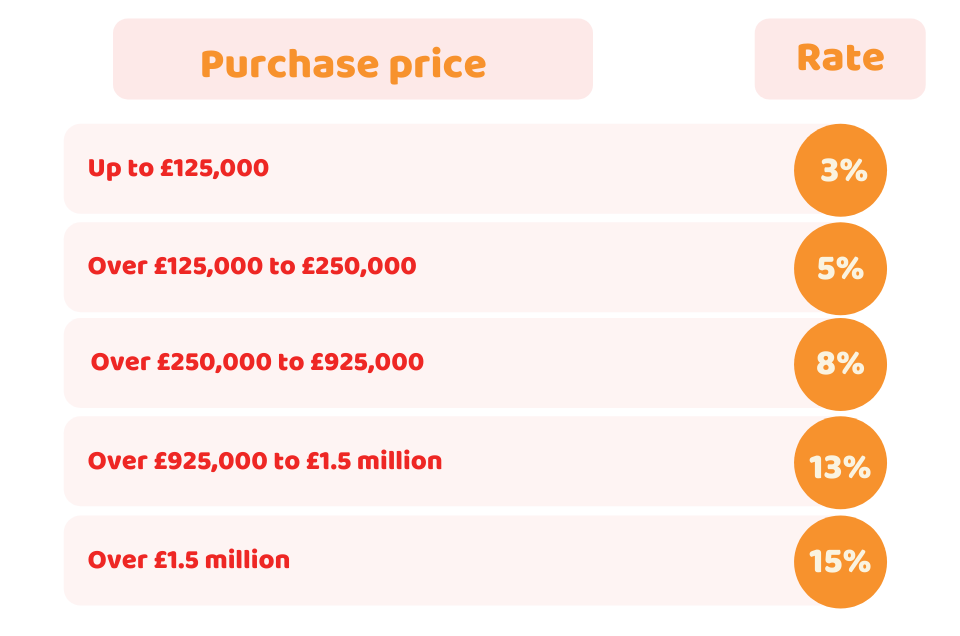

How Much is Stamp Duty on Second Home?

You have to pay an extra 3% as Stamp Duty on top of the additional stamp duty rates for buying a second home (additional property). The increased rates apply to properties worth over £40,000. Here is the table to show the higher rate of SDLT:

For further details, visit the government website.

Ways to Avoid Stamp Duty on Second Home

There are a few ways to avoid or mitigate the SDLT on a second home. These are the following:

- Buy the property for less than £40,000

- A property where there is 7 years or less left on the lease

- Inherit a 50% or less share of a property

- Purchase caravans, mobile homes or houseboats

- Sell your main residence within 3 years of purchasing the second home to avoid stamp duty surcharge

Want to reduce your SDLT on the second home, reach out to us!

When do you Have to pay Stamp Duty?

You are required to pay stamp duty within 14 days, after making a sale. SDLT1 Form that will be prepared by the transfer agent/solicitor whilst selling the property. If you fail to pay it, HMRC will levy penalties or interest on you. In addition, you are required to submit an SDLT tax return within four weeks of the transaction.

Quick Sum Up

In this blog, you have learned; how much is Stamp Duty on a second home and how to avoid it? Stamp Duty is charged if you buy a residential property or land in England or Northern Ireland over a certain threshold. If you buy a second home or a piece of land, typically, you are required to pay an extra of 3% as Stamp Duty on top of your rate. In addition, there are multiple ways to avoid and mitigate SDLT on a second home.

Note that this blog is just for general information, for expert advice, feel free to contact our property accountants for help.

It is better to consult our property accountants before making a property purchase. We offer inclusive financial services for small business owners, self-employed, and landlords at a reasonable price. You may get in touch now!

Disclaimer: This blog post is intended just for the general understanding of SDLT on a second home.