To keep a healthy cash flow, every business owner needs to keep accurate records of its expenses and revenue. After all, every business must pay its debts on time and can’t afford to commit mistakes here. Sometimes a business pays its supplier outright, but they also use different methods to pay their suppliers. Trade payables are one of the buying techniques that businesses use.

In this blog, we’ll explore:

- What are trade accounts payables?

- Why they are important?

- What are their examples?

- Understanding Trade Receivables

- Trade Accounts Payable vs Accounts Payable

- Why do businesses use them?

Accotax is an accounting firm that will help your business thrive. Contact us for affordable accounting, taxation, and payroll services at a competitive price!

What are Trade Payables?

If you are a business owner, you deal with them all the time. Don’t know what are they? These are billed from a supplier, vendor, or any third party for the delivery of goods, or provisions of services to the customer. They are a combination of creditors and the bills incurred on the purchased goods or services consumed.

In accounting, if these are paid on credit, they are recorded in the accounts payable module of the balance sheet or accounting software. However, bear in mind that they are only entered when paid on credit. If the amounts owed to the suppliers are paid outright in cash, these are no longer considered trade account payables, as they are no longer liabilities.

Generally, these payables are considered current liabilities are they are, typically, paid within a year. On the flip side, if they are owed for more than a year, they would be classified as long-term liabilities. And with the attached interest with long-term liabilities, they are taken as long-term debt.

Importance of Trade Payables

These serve an important purpose in accounting as they help to know the cost of doing business. It helps businesses to find how much is the bottom line. As a result, it helps businesses to predict their profit margin and helps them to do changes to increase it.

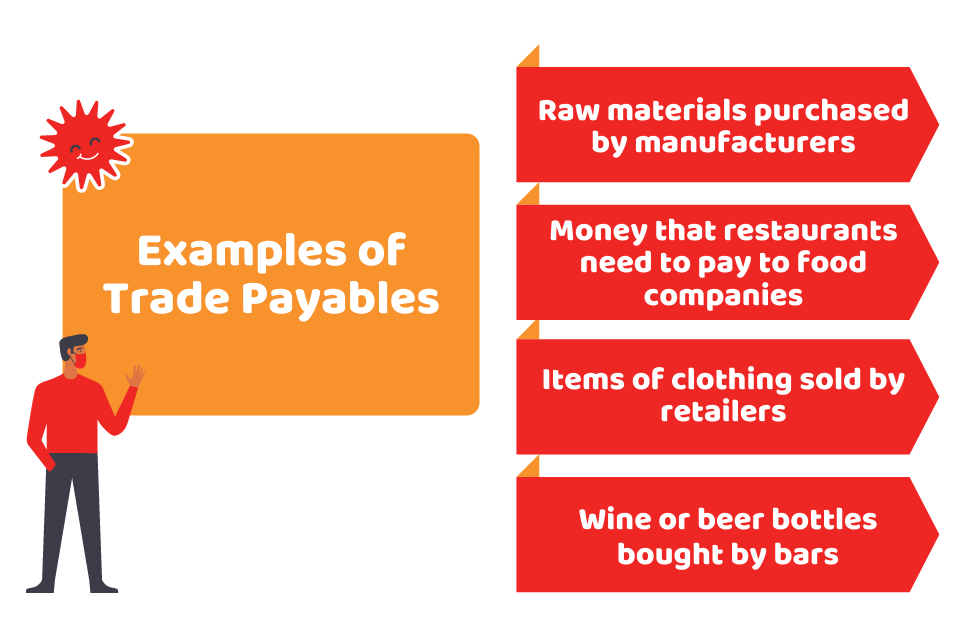

Examples of Trade Accounts Payables

You need to know that all the liabilities are not considered trade accounts payables. Employee wages, expenses or dividends payable are not examples of it. Here is the list of some trade accounts payables:

- Raw materials purchased by manufacturers

- Money that restaurants need to pay to food companies

- Items of clothing sold by retailers

- Wine or beer bottles bought by bars

Bear in mind that all these goods and services will be considered TB if they’re purchased on credit.

Our qualified accountants, bookkeepers, and tax experts in London are best at handling your finances. Get in Touch with us now!

Understanding Trade Receivables

These are the opposite of trade accounts payable, trade receivable is the money that you are going to receive against the service offered or products provided. These are classified as assets on your balance sheet. Same as trade accounts payable, they are only recorded if they are on credit.

Trade Accounts Payable vs Accounts Payable

These terms are often used interchangeably in the business world. However, they are not the same. Accounts payables show short-term debts or obligations to pay to a supplier. On the other hand, trade-payables differ to some extent as this is the money that a company owes its vendors for inventory-related products. Like business suppliers or things that are a part of the inventory.

Why do Businesses Use Trade Payable System?

There are a number of reasons to use them in your business. They are used for:

- Improving cash flow management

- Increasing short term liquidity

- Better relationship

Quick Sum Up

To sum up the discussion, trade payables play an important role to improve the cash flow by maintaining the bottom line of the business. By keeping an eye on them, you can gauge the profitability of a company. These are classified as liabilities, whereas trade receivables are taken as assets. However, the poor management of these payments can damage the relationship with the suppliers and lead you to fraud risk. So, you need to get them right.

Reach out to our certified accountants to overcome your financial worries!

Get an instant quote for a customized offer!

Disclaimer: This blog provides general information on Trade-Payables.