Since April 2016, it becomes obligatory for all UK private companies (including LLPs) to keep a register of people with significant control. It is also known as people with significant control register. This register is needed at the time of the company’s incorporation. The UK government introduced this measure to improve transparency and trust by confirming who controls the business. But what is a person of significant control, who qualifies for it, what details are needed for the PSC register and what does a company need to do?

Looking for someone to help you with record-keeping, preparing annual accounts and overall tax liabilities, Accotax is here to help. Whether you are an LLP or a limited company, be sure to get in touch with us today for a quote!

Find all the answers in this short blog!

What is a Person of Significant Control?

A PSC is a person or an entity that controls or owns your company. A person of significant control is also sometimes referred to as the beneficial owner of a company. There can be more than one PSC of a company at a time. You need to identify the PSC and should tell them their status.

Who Qualifies for PSC?

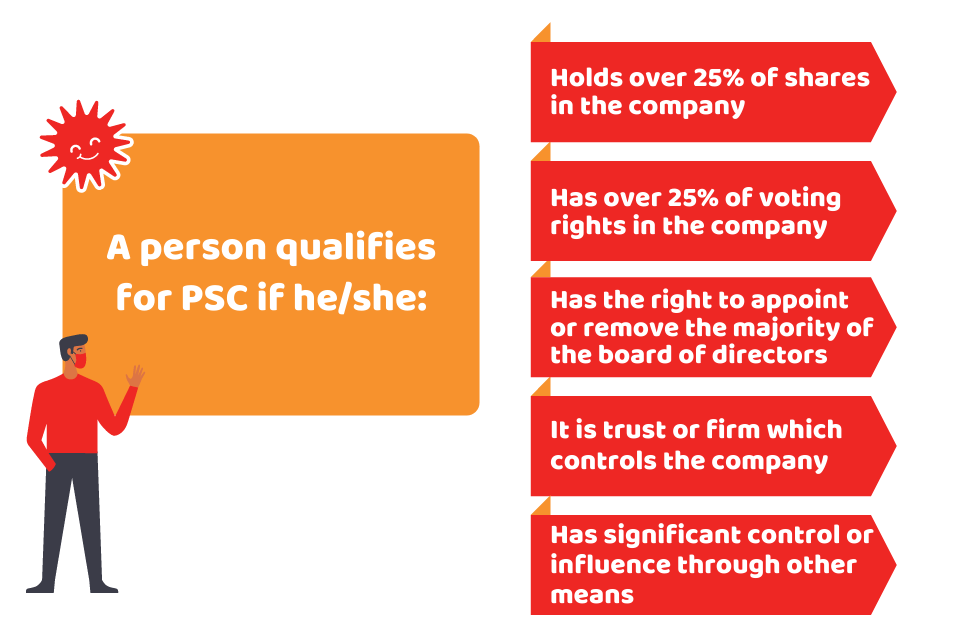

A person needs to meet one of the following conditions (nature of control) to qualify as a PSC. Most of the PSCs hold these three basic conditions:

- A PSC holds over 25% of shares in the company

- PSC has over 25% of voting rights in the company

- He/she has the right to appoint or remove the majority of the board of directors

Along with these conditions, PSCs also need to meet these two other conditions that are a bit complex from the above mentioned. They are:

- a trust or firm which controls the company

- someone who has significant control or influence through other means

With the above-mentioned qualifying factors, you need to note that a company can have multiple PSCs.

Accotax is one of the leading accounting and tax firms in the UK specialising in putting cash back into your pocket. Let us help you to claim your tax back. Give us a call on 02034411258 or request a callback!

What Details are Needed for the PSC Register?

According to Companies House, your company’s PSC must first confirm certain details about PSC and need to provide the following information:

- Name and date of birth

- Nationality and Country of residence

- Service address and Usual residential address (non-disclosed)

- The date they became a company’s PSC

- The date you put them into your PSC register

- Which conditions of control are met

Additionally, you must mention the level of their shares and voting rights, within the following categories:

- over 25% – 50%

- more than 50% and less than 75%

- 75% or more

What Does a Company Need to do?

A Company’s officer is required to:

- Find out the PSCs and confirm their information.

- Record the details of the PSC on the company’s own PSC register within two weeks.

- Deliver this information to Companies House within 2 weeks.

- Update the information on the company’s own PSC register when it changes within 14 days, and update the information at Companies House within a further 14 days.

- Ensure to Companies House that information on the public register is accurate, where it has not been updated in the previous 12 months.

How Accotax can Help

Accotax is one of the leading accounting and taxation firms in the UK. Our limited company accountants are experts in dealing with Companies House. Whether you are a limited company or an LLP, we’ll sort out all your tax, accounts and business issues in no time. We offer high-quality customer service and help business owners to focus on their core business activities.

Quick Sum Up

Hopefully, you have now got the answer to what is a person of significant control (PSC). In a broader sense, he/she is a person having over 25% shares in the company and with a significant influence on the company. The company needs to identify, maintain and provide information of PSC register to Companies House as it helps it to determine who controls a company.

If you are looking for reliable accountants in London who can help your limited company stay on top of its accounting-related needs, Accotax is here to help. Get in touch with us today for a quote!

Have a query? Feel free to reach out!

Disclaimer: This post is just written for informational purposes.