Oftentimes, running a limited company may seem like a gruelling task. With customers, suppliers, and employees to manage, company directors face difficulty carrying out the administrative and financial responsibilities of the business. To save time and money, they prefer to hand over these tasks to accountants to ensure compliance. In addition, these accountants manage everything effectively and in a timely manner. Along with other responsibilities, if the company’s annual accounts are submitted inadvertently to Companies House, accountants take remedial action by sending Companies House amended accounts.

Allow our accountants to handle the hassle of preparing and submitting annual accounts and amended accounts. Call us at 0203441 1258 or send us an email at [email protected].

Let’s see: what are amended accounts, what to do when you submit annual accounts incorrectly, what things to ensure while sending amended accounts on paper, penalties for late filings, and appeals against late filing.

Read on to learn all about them!

Companies House Amended Accounts: An Overview

The company’s annual accounts, also known as statutory accounts, are prepared with the help of the financial records at the end of the financial year. These financial documents include:

- Balance Sheet

- Profit and loss statement

- Notes about the accounts

- a director’s report (micro-entities are exempted)

If there’s a mistake, omission, or anomaly in the above-mentioned accounts after the submission, Companies House amended accounts are prepared and submitted to Companies House to notify them about a mistake or incorrection. Amended accounts or corrected accounts must be for the same period as the original accounts. There are two ways to submit amended accounts to Companies House:

- On paper

- With the help of filing software, if it is used to file your annual accounts and if it allows you to submit accounts correctly

What to do if you Submitted Incorrect Accounts?

First of all, don’t panic. Mistakes are inevitable. Anyone can commit mistakes, however, you need to take action as soon as possible to avoid further worsening the situation. So when the wrong version of your accounts is submitted, no matter for what reason, you first need to contact your accountant and notify him/her of the mistake. Your accountant will make the corrections and ensure that everything is rectified accurately and on time.

Sometimes the draft account is submitted due to urgency, so your accountant will make corrections and submit the revised account as the final version.

Secondly, you (the company director) or your accountant need to ask Companies House to remove the incorrectly filed accounts. Unfortunately, Companies House has no obligation to do it until and unless there’s something fundamentally wrong (aside from figures) that makes it rejected. Seeking a court order is the only way to remove the accounts from the company’s records; otherwise, revised accounts will be listed alongside them. Taking the help of a professional is the safest route in this regard.

Looking for someone to help you with record-keeping, preparing annual accounts, and overall tax liabilities? Accotax is here to help. Whether you are an LLP or a limited company, be sure to get in touch with us today for a quote!

What to do When Sending Amended Accounts on Paper?

The first thing you need to ensure is to write ‘amended’ on the front of the amended accounts to avoid rejection as duplicated by the Companies House. Additionally, your amended accounts must clearly state that:

- they are now the statutory accounts

- they replace the original accounts

- are prepared as they were at the date of the original accounts

Once you submit these accounts, Companies House will keep a record of the original accounts. Upon amending a single part of your accounts, you need to send a note to Companies House informing you what has been amended. And you need to file the note with a copy of the original accounts along with the director’s signature.

Penalties for Late Filing

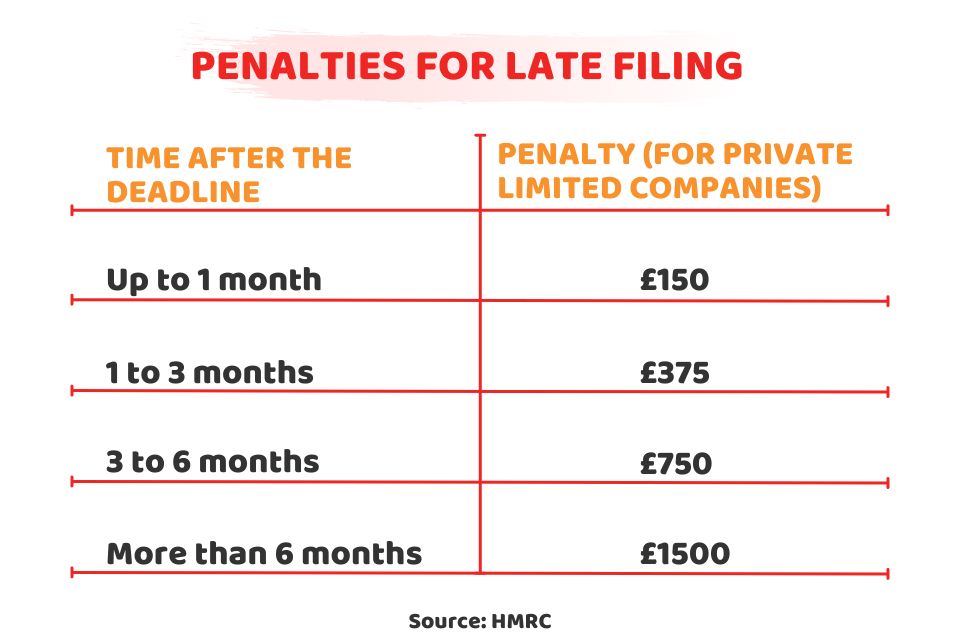

You are levied penalties by the Companies House if you do not file your accounts by the deadline. Here is the table showing the time after the deadline and the amount of penalty imposed on the private limited companies:

Note that penalties for public limited companies differ from the penalties mentioned above. If the penalties are late for two years in a row, they are doubled.

Appeal Against a Late Filing Penalty

To appeal against the late filing penalty, you must:

- include all relevant details, like dates and times

- prove the circumstances were out of your control

- provide a specific reason for not filing your accounts on time

If you need help with your appeal due to any health condition or disability, you need to contact Companies House.

How Accotax can Help!

Accotax is one of the leading accounting and taxation firms in the UK. Our team of accounting professionals is an expert in preparing and submitting annual accounts and Company House amended accounts. Whether you are a self-employed professional, a limited company, or a landlord, we’ll sort out all your tax, accounting, and business issues in no time. We offer high-quality customer service and help business owners focus on their core business activities.

If you are looking for reliable accountants in London who can help your limited company stay on top of its accounting-related needs, Accotax is here to help. Get in touch with us today for a quote!

Have a query? Feel free to reach out!

Disclaimer: This post is just written for informational purposes.