Wondering what triggers a VAT inspection? If there is an issue with your VAT records and/or your business is not paying or reclaiming the correct amount of VAT, HMRC might appoint VAT officers to visit your business for a VAT inspection. Generally, this aggressive stance is taken by HMRC to ensure that you’re complying with the VAT laws and regulations and paying or reclaiming the correct amount of VAT.

Every year, thousands of letters are being sent by HMRC to businesses notifying them about the VAT inspection. If you’re being notified, dealing with inspection officers can be troublesome and daunting. But, you don’t need to panic as it might be done due to suspicion, so you should not consider it an accusation of wrongdoing. Let’s delve deep into it.

So, in this blog we’ll discuss:

- What triggers a VAT inspection?

- How to be prepared for VAT inspection?

- What happens during the process of VAT inspection?

- Possible penalties

Looking for a VAT accountant? Look no further other than Accotax for affordable services!

What Triggers a VAT Inspection?

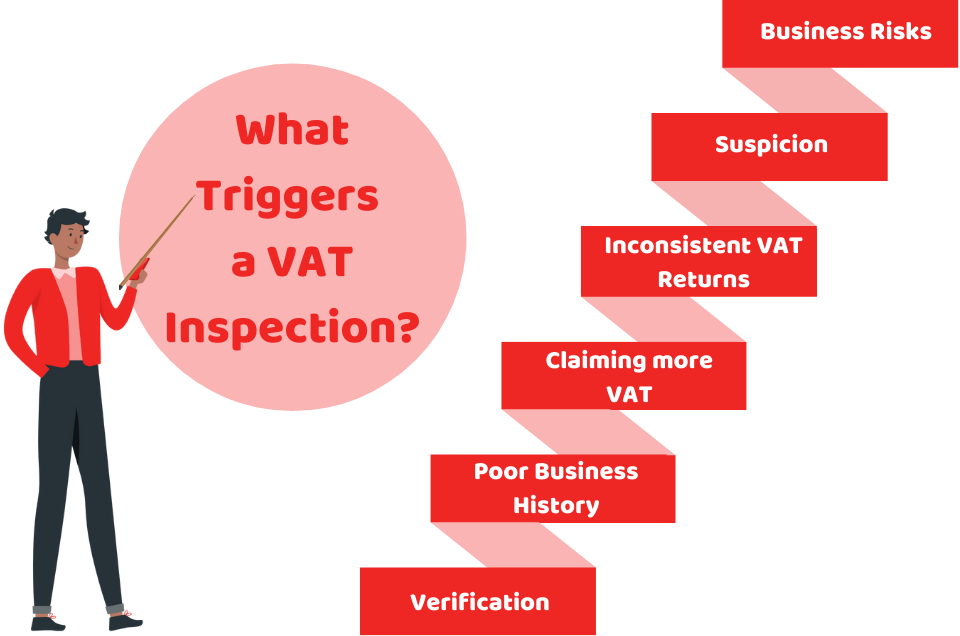

There are many reasons that trigger a VAT inspection, but these are not always direct. HMRC applies a risk-based approach for inspecting any business.

Typically, the inspection can occur due to the following reasons:

- Risk – A business sector with higher risks according to HMRC

- Suspicion – HMRC has received suspicious information about your business

- Inconsistent VAT returns – You do not submit your VAT returns on time

- Claiming more VAT – Your business has claimed VAT repayments where none were before or they’re higher than normal

- Poor Business History – If your business has a poor history of default surcharge penalties, late payments or non-payment of VAT

- Verification – HMRC wants to verify your suppliers and customers

Before an inspection, HMRC usually gives you 7-day notice before a visit of the VAT officers. You can request them to delay it if you’re not convenient with the time.

How to be Prepared for VAT Inspection?

If you got a notice from HMRC about the upcoming VAT inspection, the first and foremost thing you need to ensure is to review your accounting records. If you’re unable to do so, taking the help of a VAT accountant is the best approach for this.

Moreover, you need to be confident enough to explain your business activities to the inspection team. You need to have a firm understanding of VAT rules, the process of recording information, who is responsible to produce VAT returns and how to generate the figures.

Normally, HMRC will focus on large transactions and the areas where mistakes are common, like:

- Vehicles and fuel paid for the business

- Alteration/improvement in business activity

- Income or funding received from new sources

- Unusual transactions

- The cost incurred on entertainment by a business

As an ideal practice, your accounting records need to be reviewed beforehand and corrections and improvements need to be done before the arrival of the inspection team.

Taking the services of a qualified accountant is worth your time and money. A qualified accountant will access your accounting records thoroughly and will provide suggestions for improving them. In this way, you could be saved from hefty penalties charged by HMRC.

Be worry-free about your VAT concerns by getting in touch with our VAT accountants now!

What Happens During the Inspection?

During the inspection that VAT officers will review your VAT records and regular records like purchase and sales book, copy sales invoices, purchase invoices, banking documents, cheques books, payslips and annual accounts. Furthermore, they might ask you to provide access to your PCs and cloud bookkeeping software like Xero. To put it simply, their main purpose is to verify the accuracy of your VAT returns.

Along with reviewing the following documents, they will ask some questions about your business. For this reason, it is recommended to take help from a VAT accountant. A VAT accountant will not only prepare your records but also answers the questions asked by the inspection officers.

Possible Penalties

After undertaking an inspection, the VAT officers will discuss their findings and will cover any issues or concerns they found during the process. They will also write down their findings in a letter, that include:

- Corrections to your VAT account

- Any penalties for non-payment

- Procedural suggestions for your VAT records

- Notification of underpayment or overpayment of VAT

If there’s a serious issue found during an investigation, they might charge a 30% penalty for underpaid VAT. If the situation is worse, HMRC might file a petition in the court to appoint liquidators. And this process takes less time than other creditors.

Therefore you need to pay close attention to all details. Additionally, HMRC also has the authority to take direct action against the directors of the company.

Quick Sum Up

To sum up, after giving this post a read you have got the answer to what triggers a VAT inspection. By keeping track of your finances and operating your business in an organized way, you can avoid any possible VAT inspection. Our chartered accountants at Acotax will keep you in line with the VAT rules and regulations. They’ll provide the bespoke solution to your VAT issues. So, if you don’t have anyone to manage and monitor your VAT returns and other taxation issues, get in touch with our accountants for help.

For professional advice on preparing for VAT inspection, reach out to Accotax instantly!

Disclaimer: This blog is intended to provide general information on VAT inspection.