VAT rates vary based on the type of goods and services you are dealing with. On most goods, the standard VAT rate is charged. However, there are others too, like Zero Rated Vat items of the UK, reduced rate VAT items, and exempt items. In this blog, we’re going to differentiate Zero Rated VAT and Exempt items.

Before exploring the difference, let’s kick off with the VAT rates for a better understanding.

VAT Rates

Your goods and services are charged with three different types of VAT rates, which are following:

Standard Rate

Most of the goods and services fall under the VAT standard rate category. If your goods are below the distance selling threshold supplied from Northern Ireland to non-VAT Registered EU customers, these goods are charged at a standard rate. In case of exceeding the threshold, you are liable to register for VAT. This rate is currently 20%.

Looking for cost-effective and responsive VAT experts? Reach out right now, we’ll get back to you within the shortest possible time!

Reduced Rate

The reduced rate is applied based on the item type and the circumstances of the sales. Currently, this rate is 5% and applies to goods and services like:

- Sanitary Products

- Energy Saving measures

- Childen’s car seat

- Old people above 60 as a mobility aid

Zero Rate

VAT with zero rates doesn’t mean that zero-rated goods are exempted from this tax rather they are charged at 0%. Similar to standard and reduced rates, Zero Rated VAT items of the UK also need proper recording and reporting while doing the VAT returns. Goods and services where zero rate VAT is applied include:

- Children’s cloth and shoes

- Motorcycle Helmets

- Books and Newspaper

- Exported Goods from England, Wales and Scotland. (Great Britain)

- Exported Goods from Northern Ireland to an outside country from the UK to the EU

- Goods supplied to Northern Ireland to a VAT registered EU business. For validity, check your VAT number

If you’re willing to send goods to the EU from Northern Ireland, their VAT number and paperwork are needed for the details. Remember that these rates are subject to change in the coming years.

Exempt items

There are some items and services that are exempted from the VAT. You just need to maintain your financial records on VAT returns while purchasing exempt goods and services. These items are:

- Postage Stamps or services

- Insurance

- Health Services of the doctor

For more details on exempt items and services, click here.

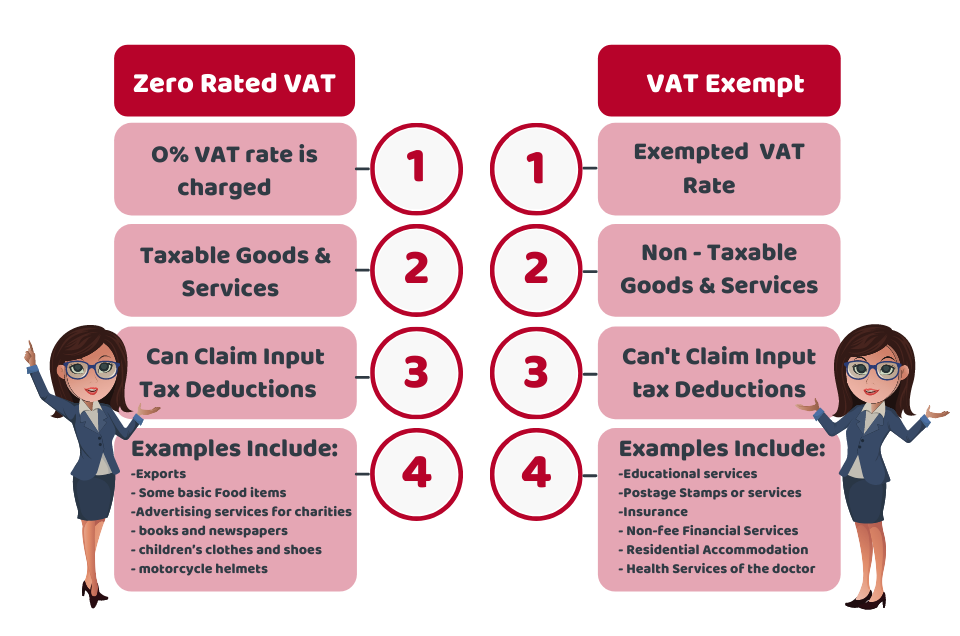

Difference Between VAT Exempt and Zero rated VAT items the UK

You can find the difference between Zero Rated VAT items and Exempt VAT with the help of this infographic:

Say bye to your financial stress with Accotax. Get in touch with our experts for any query!

Those businesses that are selling Zero Rated VAT items in the UK and services, already, have the advantage of being VAT-registered. As they can take benefit by dealing with input and output tax.

A business that pays VAT on the purchase of goods and services is known as ‘input tax’. On the other hand, if a VAT register business charges VAT on the sales of its taxable items and services is known as ‘output tax’.

After collecting VAT from the customers, the business pays it to HMRC while paying its VAT bill.

It affects business’ VAT returns. As if a business pays more VAT than it receives by selling products and services, the difference can be reclaimed from HMRC. On contrary, if it receives more VAT than it pays, it can pay back the difference to HMRC while paying its VAT bill.

How Zero Rate VAT Items Impact Your Business?

The thing that needs to be considered here is zero rate VAT as the VAT is 0% therefore there is no VAT actually charged. If a business sells only zero rated items, the VAT it pays on buying various items will be obviously more. But here, the business can claim the difference from HMRC.

Final Thoughts

If your business deals with both exempt items and Zero Rated vat items of the UK. As a result, some of your sales can be partly exempt. Therefore, you need to be cautious while categorizing the invoices to avoid errors in VAT returns. You must note that, whether it’s zero rate VAT items or exempt VAT, you need to record them in your VAT returns.

Accotax has a team of VAT experts in London to resolve your accounting and VAT issues.

Get an instant quote for customized VAT services!

Disclaimer: This blog is intended for general information on zero rated and exempt items.