Loaning money to your own Company might sound the simplest way but it comes with legal and tax implications too.

According to recent research, every twelve seconds, one home based business starts and there are 38M home based businesses. To start the company, capital is one of the most important components. People choose to lend money to their own business but this is something that you should assure in the early forming stage of your business.

Often, people confuse loaning with investing money. Carry on reading to add more to your knowledge about Loaning money to your Own Company.

Tired of taxation problems? Take your break and let Our Experts handle the rest!

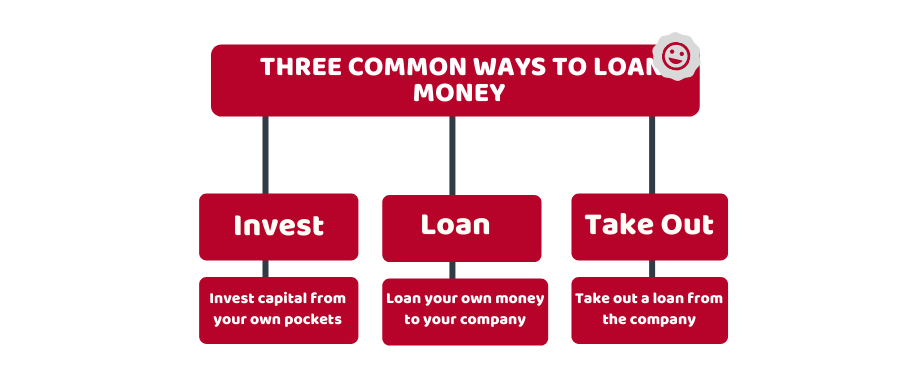

Three Common ways to Loan Money to Your Own Company:

Usually the mentioned three ways are most common to Loaning Money to your Own Company. They are listed as:

- Invest capital from your own pockets.

- Loan your own money to your company.

- Take out a loan from the company.

Your business could be newly established, home based or any other kind, you can not escape tax implications even if you loan your company from your own pockets.

Loaning Money to set-up your Own Business:

In case an individual intends to start his own company and is seeking the possibilities to get a loan. One must gather enough information about the risks and benefits of loaning the business at the initial stage. Either you seek out friends and family for this purpose, go for commercial loan from the bank or plan Loaning money to your own company.

Before you finally proceed with the loan process, prepare the best for the worst scenarios in case the business fails. Let’s look into details of borrowing money from the followings:

- Friends and Family.

- Commercial Loan from the Banks.

- Loaning Money to your Own Company

1- Friends and Family:

Before you opt friends or family for loaning money for your company, reconsider the consequences because the risk alert is high. In case of being incapable of repaying the amount, you will not face financial trouble but your relations will be at risk too.

Another important component is to consider the matter as serious as loaning from the bank. The documentation should have complete details about terms and conditions, interest, payments and the consequences if unable to repay the amount. Since, on average 66% of businesses fail every ten years, 50% every five years and 30% every five years. The goal is to keep transactions at arm’s length and follow all the rules to avoid conflicts over interest just like in any other kind of lending process. The moment you will take it casually as a family thing, you will lose it. Be fully prepared for the worst in case the company fails and you go bankrupt because then you will lose control over what your family gets in episodes, all or none.

Connect to Our Advisory for more Finance Resources to flourish your business instantly!

2- Commercial Loan From the Bank:

If you seek out less chances of risk and the safest way to minimize legal risk and taxation, loaning money to your own company from a bank is called preferable by most businessmen. Before the bank initiates the process, the bank requires it to investigate business plans, marketing strategies and finances. The bank might also check your personal assets.

Another option of loaning money could be Small Business Administration as well. They benefit newly established companies with loan schemes.

3- Finally, Loaning from your Own Pocket:

While you are seeking the easiest and cleanest way to loan money for your own company, you are burdened under the weight of debt as well regardless if you do it with your own pocket. The consequences and implications will remain the same. Since, the company has to pay the monthly episodes of repaying and interest.

To avoid the chaos of law violation, this has to be taken more seriously and documentation with regular checks is to be done just as the way it is done with any other lender. The best business suggestion in this case is to involve a third party who keeps the track paperwork. As we know in case the business fails and you go bankrupt, the creditors are repaid first. So, you have no guarantee to be paid at first priority.

Moreover, the component of interest is advantageous for the business because it lowers the tax amount. Whereas, the interest is taken as an increase in income which may affect the tax status and this makes you pay more taxes.

Our Certified Chartered Accountants offer guidance on ways to be tax-efficient, reach out instantly!

Quick Wrap up

In Conclusion, the act of Loaning Money to your Company holds facts that include benefits and risks both at the same time. You become the lender but create debt for your company which it will pay in monthly episodes, in case your business fails and you go bankrupt, there is no guarantee to be repaid on first priority before the creditors. So, this is a must to be considered before jumping in for the loan money.