Introduced in October 2012, automatic enrolment for employees is a government initiative, whereby every employer needs to contribute and automatically enrol eligible staff to a workplace pension scheme. Generally, employees also need to contribute to this scheme on which the government often provides tax relief.

This scheme is aimed at helping people to save money for their retirement. At first, this scheme was for some employers, but later in 2018, it applies to all employers in the UK. Remember, you’re an employer if you pay tax and NICs from your employee’s income.

According to a report by The Pensions Regular 2019, 1.4 million employers are fulfilling their automatic enrolment duties that has yield 10 million employees to save in the workplace pension.

In this blog, we’ll explore how to qualify for automatic enrolment, how much you need to contribute and how it works if you have two or more jobs.

Read on to find out!

How can I qualify for Automatic Enrolment?

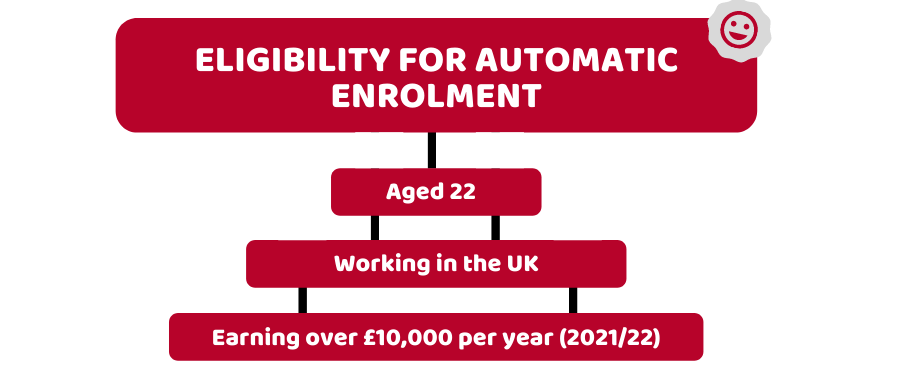

Your employer will automatically enrol you if you fulfil the below conditions:

- You have reached stage pension age, which is 22 (calculate your state pension age here)

- You are working in the UK with a contract of employment or service contract

- You’re earning above £10,000 per year (2021/22)

If you meet the eligibility criteria, your employer will inform you about it. If you’re self-employed running a business through your own account, you’re not eligible for automatic enrolment for employees.

However, if you’re looking to set up a pension scheme, contact us.

How much to contribute?

Usually, a certain percentage from your qualified earning is deducted as the pension amount. It includes your salary, wages, bonuses, commission, and statutory pay from your gross earnings. Currently, your employer will pay a minimum of 3% and you’ll be going to pay 5% from your earning making a total of 8%.

You need to be aware that this percentage is applied to your qualified earning between £6,240 and £50,270 a year (2021/22) depending upon how often you’re paid.

After the contribution, you’d often get tax relief on it. Your employer may also use different approaches like a net pay arrangement, where you may not get tax relief unless your income is over £12,570 (in 2021/22). Therefore, you should check what scheme your employer is using.

Want to get tax relief on your contribution. Reach out to Accotax!

How it works if you have two jobs or more?

In case if you have two or more jobs, each job will be considered apart from the other for automatic enrolment purposes. It means that some jobs will enrol you to contribute for pension and some jobs won’t.

The employer will decide your eligibility for the pension scheme. If you qualify, you’ll be automatically enrolled in that pension scheme. However, you may opt-out, if you don’t want to avail more than one pension scheme. You can enrol to more than one pension scheme as per your wish.

If you’re earning over £6,240 but below £10,000, you won’t be enrolled automatically. But you may ask to do so. In such a case, your employer will also contribute. On contrary, if you earn below £6,240 in a year, you can still ask your employer to join workplace pension scheme, but here the employer will not contribute.

To reduce your tax liabilities, get in touch with our accountant!

Quick Wrap Up:

So, you have got enough information on automatic enrolment for employees. If you’re already enrolled in a workplace pension scheme, we advise you not to opt-out as it means you are refusing the contribution of your employer into your pension sum. Your employer’s contribution to your workplace pension scheme is a kind of additional pay benefit that you get.

For this reason, this pension scheme is a great way to do savings for your retirement. However, there might be a few instances where opting out is a better option, like you’re facing unmanageable debts.

If you are unable to manage your finances, our chartered accountants in London are always here for your help.

Contact us anytime, we’ll get back to you in the shortest time possible!

Disclaimer: This blog is written for general information on automatic enrolment.