In case you wish to have a good insight into your company’s liquidity, learning how to calculate the current ratio is a good idea. Without a good insight into your company’s solvency, it is nearly impossible to maintain a clear picture of its financial health. This comprehensive article will help to find out more about the current ratio and the relevant details which includes the following:

- What is the Current Ratio?

- How to Calculate the Current Ratio?

- Current Ratio Formula – Limitations!

- The Bottom Line

Need help to learn about your company’s current ratio? Speak to one of our qualified accountants? Give us a call on 02034411258 or request a callback. We are available from 9:00 am – 05:30 pm Monday to Friday.

What is the Current Ratio?

It depends on the type of industry that your company belong to which helps to determine whether your company has a good current ratio or not. The possible case most of the time is that the ratio which is between 1.5 to 3 is well accepted. However, there is a chance of certain creditors and investors who might look for even a higher figure in this case.

Moreover, if the current ratio of your company is less than 1, this indicates that the company is in a bad liquidity condition or is not stable enough in terms of financial stability. This is also important to know that a higher current ratio figure does not always indicate that the company is in good financial health.

For instance, if your company has a current ratio of 9 or 10, this clearly indicates unstable financial problems like company accounts carrying too much cash and there is a serious problem with capital allocation. Since with a business, perspective encourages the capital to be spent on business growth rather than kept in the accounts.

Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

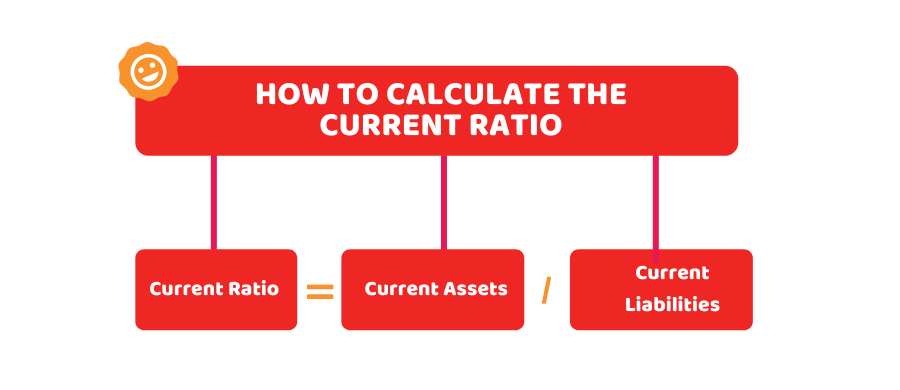

How to Calculate the Current Ratio?

The following formula is used to calculate the current ratio:

Current Ratio = Current Assets / Current Liabilities

We intend to break down this relatively simple equation. The current assets of a company are the assets that are easily convertible into cash within the time period of a year. The includes the following:

- Cash Equivalent

- Marketable securities

- Prepaid expenses

- Inventory

- Accounts receivable

Financial obligations that are short-term are called current liabilities. This includes the following examples:

- Short-term debts

- Accounts Payable

- Taxes owed in the coming year

- Interest on Outstanding Tax

- Dividends payable

The exact understanding of your current assets and current liabilities is in your balance sheet.

Looking for all-inclusive monthly packages for your company? Let us take care of your affairs so that you can focus on your business.

Current Ratio Formula – Limitations!

In spite of the fact of the current ratio is instantly helpful, there are certain limitations associated with the method of calculating it. This includes the following:

- You are required to include the liquid assets like accounts receivable and inventory as well.

- Also, when it comes to the short-term liquidity of a business, the formula might not work as the best option to use.

- In the case of seasonal businesses, the mentioned formula doesn’t always give accurate results because of the wild variations of the selected time period.

- Moreover, the best use of the current ratio formula is applicable on an extended time period project or business to determine better and accurate accounting liquidity as well as current assets to liabilities.

Are you still confused and need professional help to calculate your company’s current ratio? Our qualified accountants have all the possible solutions that can help. Do reach out today!

The Bottom Line:

Now that you have developed a better understanding of what is the current ratio and how to calculate the current ratio, we can sum up the discussion by saying that it turns out to be helpful to determine the required results with more accuracy for the businesses that are carried out in long run. Short-term and seasonal businesses are not recommended to use the current ratio because the swift variations don’t allow for accurate results.

We hope this article helped to know the current ratio and relevant details in a better way!

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

Disclaimer: This article intends to provide general information based on what the current ratio is and how to calculate the current ratio?