Computers, stationary or even machinery are all business assets that have a limited life span. With their usage, their value diminishes over time. When it comes to depreciation, it is an accounting term that shows the cost of using an asset over a certain period while it’s beneficial to your business. It affects your bottom line, tax bill and the business’ worth. For these reasons, you need to know what is depreciation and how to work out depreciation?

And if you don’t want to calculate it yourself, you can always get in touch with our qualified accountants at Accotax!

Keep reading this blog till the end to get a full grasp of the depreciation. So, without any delay, let’s kick off with the definition!

What is Depreciation?

When the assets of your business start losing their value over time, this process is known as depreciation. As a result, it brings down the value of assets on the balance sheet. As when an asset depreciates, you can’t sell it at the price you bought it for.

In addition, depreciation is considered a day-to-day running cost on the profit and loss account of the business as the business utilises its value for sales and to earn profit. For example, a computer with time depreciates and reduces its original price to zero when it is no longer usable.

Depreciable Assets

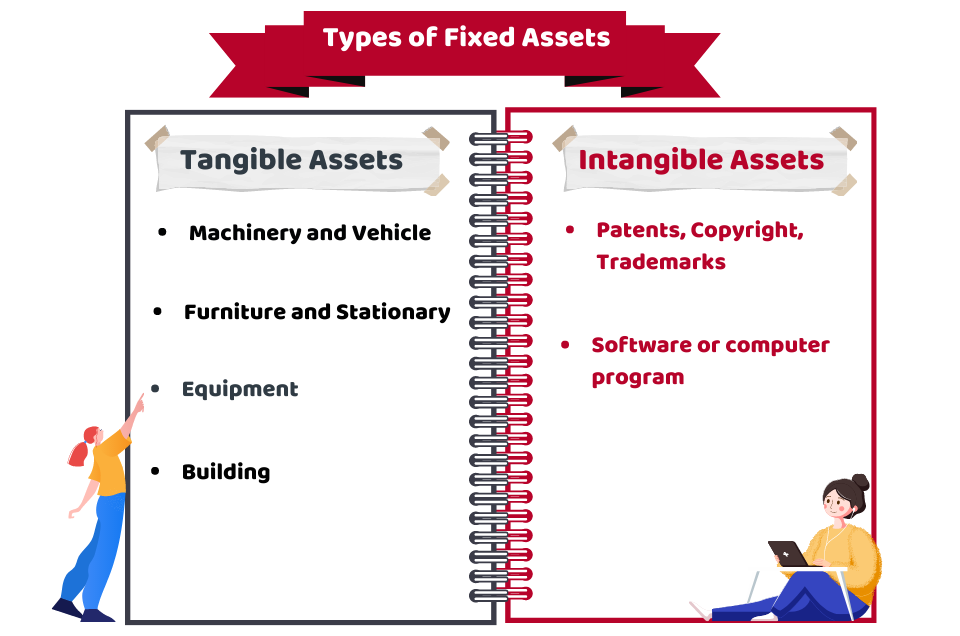

Depreciation is applied to tangible assets that reduce their value, naturally deteriorate or become obsolete or useless over time. There are various tangible assets that depreciate and they’re categorised for reporting in the balance sheet. However, the term used for the diminishing value of intangible assets is known as amortization. Here is the table showing types of fixed assets, both tangible and intangible assets:

Why Depreciation is needed?

Depreciation lets you know the actual cost of your business by figuring out how much value of the assets has decreased in a certain period. And this depreciation is taken as an expense. If you don’t keep track of depreciation, you can’t know the actual value of profit your business is making.

Secondly, along with reducing your profit, it decreases your tax bill. If you ignore depreciation, you’ll pay more tax than the actual amount.

Yes, you can mitigate your tax burden by being legally compliant with HMRC by our taxation services. Contact us now!

Thirdly, you need depreciation to figure out the actual worth of your business. To do it, you need to update the fixed assets register section of the balance sheet to work out the depreciation. Besides, you need to remember that you can use your assets as security to get loans, so if they’re depreciated, you’d be getting less amount of loan or it’d be difficult to get them.

For these reasons, it’s crucial to keep track of the depreciation.

How to Work Out Depreciation in the UK?

To determine how the value of an asset is diminishing over time and how quick this process is taking place, you need to calculate depreciation. There are multiple ways to work out depreciation in the UK.

Need an accountant to work out your depreciation? Don’t hesitate to get in touch, we’d love to help you!

The most common methods are as follows:

Straight Line Depreciation

In this method, the value of assets depreciates at an equal amount every year, until it becomes useless. For example, an asset with a lifespan of three years would depreciate by one-third of its price every year. Here is the simple formula of this method:

Cost of the asset at purchase/number of years expected to be useful = value

Diminishing Value Depreciation

Under this method, asset depreciates at a higher percentage in the first few years. And the rate of depreciation declines over time. You can calculate depreciation using this method by this formula:

Purchase Cost of an asset x reducing balance percentage / Projected lifespan in years

Units of Production Depreciation

You can better measure the lifespan of some products by their work rather than their time. For instance, a car might run for certain miles or a packing machine might pack a certain number of products. So, these assets are depreciable based on their working capability instead of their age.

Formula:

(Cost – residual/salvage value) x (Number of units produced / Life in a number of units)

Quick Sum Up

To sum up, you have got the basic information on what is depreciation, what are depreciable assets, why depreciation is important and how to work out depreciation. This information will help you to better understand the cost of your assets, reduce your tax bill and increase the value of your business. In addition, if you don’t want to work out manually, you can adopt the depreciation schedule of HMRC using your accounting software to send accurate information directly to your tax return.

Additionally, if you need the support of a tax accountant to file your tax return. Reach out to our Chartered accountants in London for help!

Need a tailored offer, get an instant quote right now!

Disclaimer: This blog provides general information on Depreciation.