“Paid in arrears” might seem a complicated accounting term for you, but it’s pretty straightforward? Let’s explore what does it mean, its pros and cons and how does it affect the payroll calculation?

Read this blog till the end to get all the answers and more.

Accotax is an accounting firm that offers inclusive financial services for small business owners, self-employed, landlords and freelancers at a reasonable price. If you’re the one, you may contact us today!

What is Paid in Arrears?

Commonly paid in arrears are used for two purposes: billing and paying.

- Payment in arrears refers to the process of billing a service provider after providing goods or services. It shows that payment is going to be made at the end of a certain period, rather than in advance. Besides, arrears payroll also works like this.

- Arrears also refer to the fact that your business is behind the payments. It means you have crossed your deadline. When you pay in arrears, you have to pay it along with your previous payment, with each subsequent payment.

Understanding these concepts is imperative to apply them effectively as per your business needs.

If you need an expert to manage your payroll, reach out to our accountants!

Why do Businesses pay in arrears?

Commonly, small businesses pay their employees and service providers in arrears. Making the payments at the end of a pay period helps businesses manage cash flow and secure financing by getting money from the debtors and generating more sales. In this way, it allows them to meet their immediate needs by paying for the services or goods in the future.

In addition, paying in arrears makes it easy to run or calculate payroll, especially when you have provided a commission or tip for your employees. Paying your employees after getting their services gives you sufficient time to work out:

- Regular or overtime working hours

- Gained tips

- Earning on commissions or sales

- PTO taken

You work them out into your employees’ paychecks while paying in arrears.

Payroll in arrears means to pay employees for the work they’ve already performed in the previous weeks. Conversely, current pay means that your payroll department will work out the estimated number of days and hours you worked and process the payments accordingly. These payments are usually given during the pay period or after the end of it.

Get the best Payroll services with Accotax!

Pros and Cons of Paying in Arrears

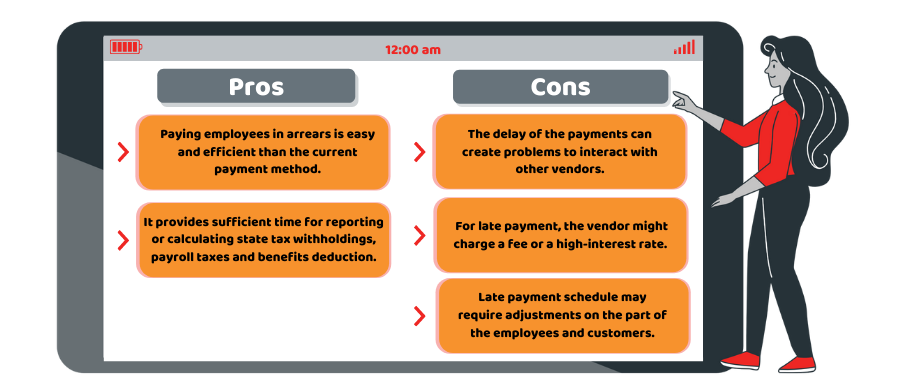

If you’re willing to implement an arrears payroll, you must consider its pros and cons before its implementation. By knowing its pros and cons, you can figure out if it’s a right fit for your business or not.

Pros

- Paying employees in arrears is easy and efficient than the current payment method.

- It provides sufficient time for reporting or calculating state tax withholdings, payroll taxes, and benefits deductions.

However, you need to know that the working hours of the employees vary week to week. Therefore it is better to inform them that you have used the arrears payment method for their paychecks.

Cons

Along with the above benefits, you might come across some complications.

- The delay of the payments can create problems to interact with other vendors.

- For late payment, the vendor might charge a fee or a high interest rate.

- A late payment schedule may require adjustments on the part of the employees and customers.

However, you can avoid these downsides of arrears by consistent interaction with your vendors, employees and customers.

Tips for Paying in Arrears

Being a small business owner, dealing with the arrears pay may be a daunting task, whether it’s what you owe or expect. Here are some tips for helping the process of being paid in arrears. Consider the following to make the process of being paid in arrears easy and convenient:

- Audit your accounts payable regularly to be up to date.

- Keep a look at the businesses that pay you – a company having a large sum of arrears could mean that you’re not going to get the payments anymore.

- If one of your clients or business has gone too far in arrears, you need to stop your business arrangement with it temporarily until it became current to be on the safe side.

Conclusion

In conclusion, we can say that if your employees, clients or customers are paid in arrears, it’d not be a good sign for your business as it means that you’re behind your bills. As a consequence, your vendor can charge late fees or higher interest. Furthermore, the clients can also shorten the duration to pay in the future, and sometimes many companies or individuals may refuse to do business with you. Hopefully, this blog clears up all your ambiguities about paying in arrears.

We offer the Best Accounting and taxation services to grow your business in the UK, contact now!

Get an instant quote for a customized offer!

Disclaimer: This blog provides general information on paid in arrears.