Hundreds of business startup grants for unemployed are available across the UK. So, if you’re unemployed looking for a grant to start your own business venture, read on to find out all in this short blog.

When you’re unemployed, you become hopeless, wondering where you can get financial support for your business.

You might feel that you can’t get a grant to set up your own business. As banks need your credit history for lending money, while investors are hesitant to support you due to the lack of resources and financial securities. Moreover, if you don’t have contacts in the business world, there are rare chances to get support.

Fortunately, there are a range of startup grants for unemployed people to establish their business without much hassle.

Want to raise finances? Accotax has a team of accountants to help you achieve financial stability. Feel free to reach out!

Business Startup Grants for Unemployed:

There are a lot of grants for unemployed in the UK each with strict guidelines and eligibility criteria based on your business type, its objective, location and other details.

If you’re not employed, you’re not confined only to the schemes of unemployed people. There are dozens of grant-awarding bodies that provide equal opportunities for both employed and unemployed people.

However, with a wide range of schemes available with different purposes, we will be exploring the business startup grants for unemployed, where you’d be likely fit into their eligibility criteria that will save your time and energy. From the following grants, you’ll likely get business funds for your startup.

Let’s talk about New Enterprise Allowance (NEA) scheme first.

New Enterprise Allowance (NEA):

New Enterprise Allowance (NEA) is a government scheme that aims at helping unemployed individuals for becoming self-employed by starting their own business. If you’re selected for this scheme, a business mentor will guide and advice you for writing the business plan.

After the approval of your business plan by the mentor, you can apply to get a weekly allowance of £1,274. You’d get this allowance for 26 weeks as part of NEA participation. Moreover, you can also apply for the further start-up cost worth up to £1,000, along with this scheme. The mentor will guide you to set up your business till it starts trading.

You must fulfil the following conditions to be eligible for NEA:

- You are 18+

- You or your partner receive Jobseeker’s Allowance, or Employment and Support Allowance or Universal Credit

- You receive Income Support; you’re disabled or sick or a lone parent

The Prince’s Trust Scheme:

Prince’s Trust is a charity organization that helps young entrepreneurs to get funds for their business. It supports people living in England, Wales, Scotland and Northern Ireland. This scheme provides a startup loan up to £5,000. It also provides low-interest loans for sole traders up to £4,000 and £5,000 for partnership.

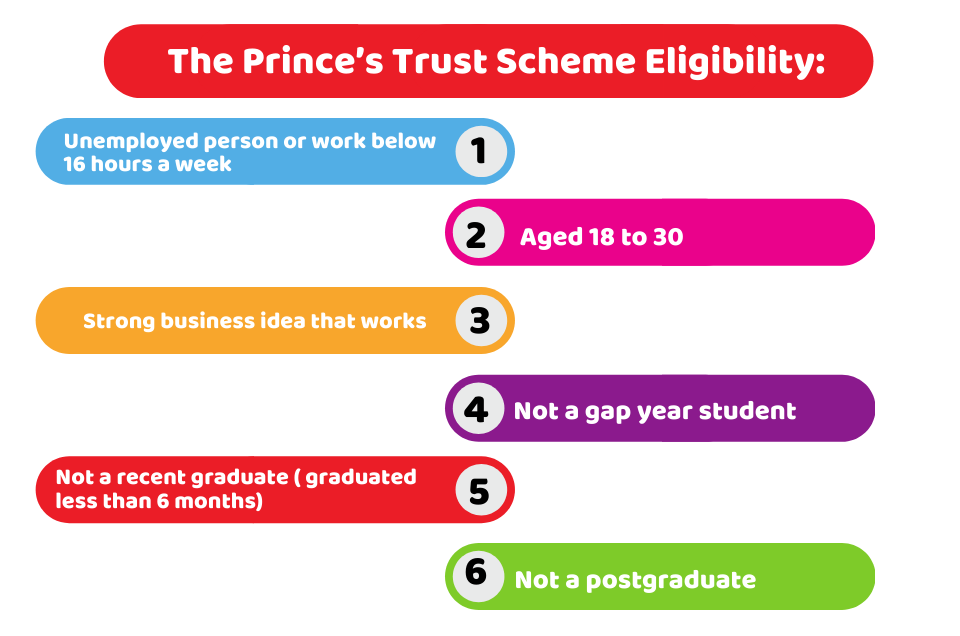

You’re eligible for this scheme if:

- You’re an unemployed person or work below 16 hours a week

- Your age is 18-30

- You have a viable business idea that works

- You’re not a gap year student

- You’re not a recent graduate ( graduated less than 6 months)

- You’re not a postgraduate

This scheme provides special support for ethnic minorities, disabled persons, people of deprived areas and people with limited formal education.

Need financial advice? Get help from our experts CPA!

The Royal British Legion’s Be The Boss Scheme:

If you have provided services for the armed forces and are unemployed recently, you might qualify for this scheme. This scheme provides veterans and servicemen and women with a business grant up to £7,500, and a loan of £30,000.

Local Schemes:

The schemes which we have discussed till now are available on a national scale, your local council also provides various schemes for unemployed people helping them to establish their business. For instance, Broadland District Council’s start up grant provides £750 for unemployed entrepreneurs in the areas of Broadland District of Norfolk.

Likewise, Youth Business Scotland is the local scheme for unemployed people aged from 18 to 30 in Scotland.

To be eligible, the applicant needs to submit a business plan and cash flow forecast and the business must not have started its operations. Get in touch with your local authorities to find out your local schemes.

Quick Wrap Up:

To conclude, we have discussed the most common business startup grants for unemployed in the UK. Once you have found a suitable scheme, you should apply for it right away. Though there is a lot of competition for achieving a business grant, but you’d most likely get the chance to avail the scheme if you follow their guidelines.

Many business grants providers need you to submit a cash flow forecast of your business that you want to establish. It might be challenging for you due to the financial complexities, therefore we recommend you to take the help of our accountants to do it to qualify for the grant.

Accotax has a team of professional accountants who’ll help you to achieve a business grant by preparing a perfect cash flow forecast. Get an instant quote now!

Disclaimer: This blog provides general information on startup business grants.