If you’ve decided to set up a limited company in the UK, it might be one of the best decisions of your life. Wondering how! Let’s make it easy. Along with financial security, a limited company grooms your personality and gives a boost to your professional status. With a limited company, you get paid for your work. So, let’s see how to start a limited company in the UK.

Starting a limited company means you have got a new identity in the form of your brand. In a limited company, you own the responsibility of your work, practice the tax-efficient ways while operating your business, and do the work collectively as a team.

Before discussing the process to start a limited company. Let’s see what is a limited company, what are its advantages, and what you need to start a limited company.

Get expert advice to start a limited company with our Limited Company Accountant!

Limited Company:

As we’re aware of the fact that this legal structure is separate from your personal business (unlike sole trader). It contains shareholders and directors that represent the limited company. Due to limited liability, you can take large risks. A limited company is more time-consuming, needs more paperwork and responsibilities to operate than a sole proprietorship.

Advantages of Limited Company:

- Tax Efficient: Compared to a sole trader, it is tax-efficient. You pay corporation tax on the behalf of your business. You can take dividends and salary as your pay.

- Professional: Many industries consider the limited company professional than others. As an advantage, you can maintain trust with your suppliers and customers, get more investment, and can sell your business.

- Sperate form Personal Property: Your business is a separate legal entity means if something unfortunate happens, your personal property would not be involved.

What you Need to Start a Limited Company:

That’s what you need to start a limited company:

- Time: You need time and energy to take legal responsibilities and administrative decisions for a limited company than a sole trader.

- Money: Though companies house only charge £15 to register a limited company, there are other costs for running the business like (Office expense, salary, goods, bills, etc)

- Public Property: As a limited company, you become public property as your earnings, directors and other details are shared are publicly on the companies house website.

We know that you’re curious to learn how to start a limited company in the UK, here’s what you should know.

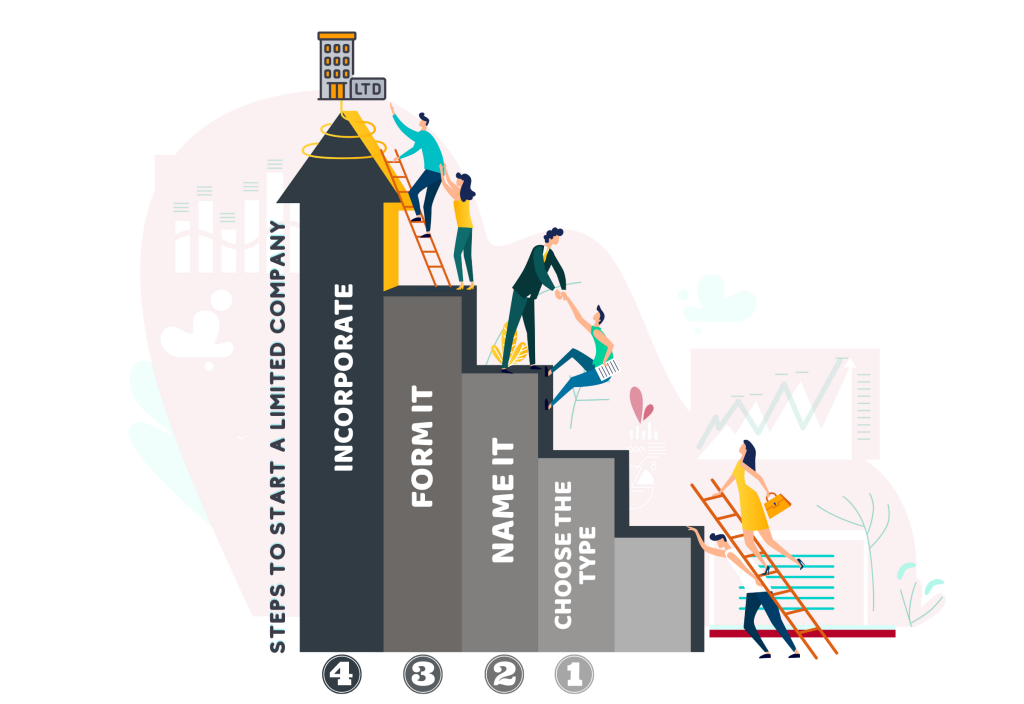

How to Start a Limited Company in the UK?

The steps for starting a limited company may differ as per your circumstance. Here, we have listed down some major steps you need to take before starting a limited company.

1. Choose the Type of Limited Company:

The first thing you need to do is to choose the type of limited company. There are two types: Public Limited Company (PLCs) and Private Limited Company (LTDs). If you are a startup, freelancer, contractor, or small business, you should start a private limited company as it is more cost-efficient. To start a Private limited company, you just need £1 as there’s no small limit of share capital. However, you need £50,000 to start a Public Limited Company. Besides, PLCs also needs two shareholders, directors, and a qualified secretary.

2. Pick a Name for your Company:

This process can be the most frustrating and funny at the same time. As your company name should be unique and different from other companies like a web address. As there are hundreds of companies formed every day. Therefore you should select a suitable name that represents your brand.

3. Form your Limited Company:

This step is a challenging part, but if you want to avoid this step, contact our Limited Company Accountants at Accotax to set up your limited company within no time. Our charges are as low as you can afford to pay.

If you confident enough to form it by yourself, great. As a company director, provide personal details to companies house including:

- Submit a SIC code (Standard Industrial Classification code) to Companies house to let them know of the business type your company is trading. your business. Select the suitable SIC code for your business through the list of SIC codes here.

- Finalize the address where you want to start your business. It should be the registered office address of the company to submit it to companies house.

- Decide the number of your shareholders (shareholdings), director, and ownership status of your company.

After completing the above process, the companies house will start considering your company.

4. Incorporate your Company:

In the UK, the companies house is responsible for registration and incorporation. You can visit their online website to do it. To simplify, let our Limited Company Accountant to do it on your behalf.

You need to complete the following documents and return them to companies house to do the incorporation process.

- Memorandum of Association

- Article of Association

- Form 10

- Form 12

- Form IN01

This is how to start a limited company in the UK! Let’s discuss what to do after registering your limited company?

What to do After Registration?

Once you’ve registered your company, you will receive a certificate of incorporation as evidence of your existence. On this certificate, you can find out the company number, and its formation date. Afterward, you should register your company to HMRC within the duration of three months of your business.

Ask us what to do next!

Quick Sum Up:

We hope you know how to start a limited company in the UK now. After starting your company, work on company administration. You have to manage the vexing duties of reporting and filing taxes. You should fulfill the administrative responsibilities. Setting a business bank account could be the first step. Likewise, there are many other proceedings.

Get the help of our expert Limited Company Accountants to start your company from scratch!

For advice and guidance, you may contact us anytime!

Disclaimer: This blog aims to provide information about starting a limited company in the UK.