Choosing the right accountant is crucial for your business success. A good accountant is your business partner who provides appropriate advice for your business progress; saving your time, efforts, and money. However, a bad accountant will cost you more. The challenging part is to choose the right accountant as they’re in thousands. Along with the prerequisites, we’ll find out how to choose right accountant in the UK. Let’s start.

Tips to Choose the Right Accountant in the UK:

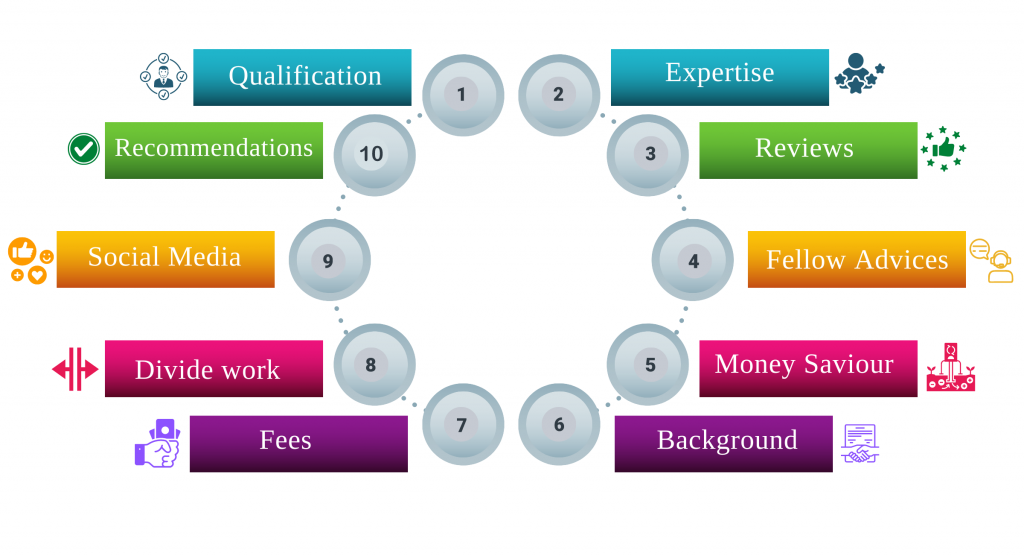

You need to consider many things to choose the right accountant. You should be aware of the issues arising due to the accountant’s qualification, location, field of expertise, workload, and accounting methods. Consider what would be the charges of your accountant and whether he/she can help you to lower down your business liabilities or not.

Find out how we can help you to satisfy your financial need!

It is in the best interest of your business to choose a qualified and experienced person for handling the finances of your business. So these are the things you should look for before choosing an accountant:

1. Qualification of Accountant:

The qualification of your accountant matters a lot. As if you don’t know the basics of accounting or finance, you can’t review the work of your accountant yourself. So for peace of mind choose a qualified accountant who is certified by a recognized institution or government. As per the job responsibilities an accountant might be a:

- Chartered Accountant

- Certified Public Accountant

- Forensic accountant

- Management accountant

- Auditor

- Cost accountant

- Government accountant

- Project accountant

- Staff accountant

- Investment accountant

You should know that Chartered Accountants are highly qualified accountants having more expertise, qualifications, and exposure in the field. Therefore, it is advisable to hire a good accountant from the start, for your business growth from scratch rather than hiring one for later.

Choosing a chartered accountant doesn’t mean that you can’t go for a normal accountant. You can select an average accountant for bookkeeping, financial management and taxation. But it’s better to hire a chartered accountant if you’re taking a loan or you’re going to be audited.

Accotax has a team of certified chartered accountants in London to provide affordable financial services for you. Just let us know your needs!

2. Revelvant Expertise and Experience:

Your accountants should have the relevant expertise and experience in the industry and domain in which you’re working. Like the person should have experience in bookkeeping, preparing tax returns, and making financial reports for a company that is similar to yours. If you’re working on online software, your accountant needs to be well aware of it.

In this regard, you can ask your accountant about the previous clients’ details and analyze their business growth to know whether the person will suit your company or not.

3. Take Advice from Associations:

To find out the most suitable accountant ask business associations and advisers to help you in selecting the right accountant. Many organizations are there to advise you for free. In the network of business owners, you’d be provided valuable recommendations and suggestions to select the right accountant for you.

4. Use Social Media:

You can take advantage of social media to choose the right accountant for you. Sometimes your accountant might be right under your nose, therefore asking friends and relatives, who own a business will be good. You can also take the help of Facebook and other platforms to find out a suitable match for your business.

Whereas the best platforms for picking up an accountant is LinkedIn, where you’ll find the accountant’s job description, connections, recommendations, experience, and reviews that will make your selection process easier.

5. Divide the Work:

Though accountants can do everything related to bookkeeping and accounting. But, it is recommended to divide your works for the best results. Take the responsibility to do the basic data entry job as the accountant is going to charge you on an hourly basis. This would save you money. Your accountant will work on complex tasks like bank reconciliation, payroll, filling out tax returns, and depreciation calculation of capital, etc.

Accounting software like QuickBooks, Xero, Odoo, and Sage will help you to do basic accounting.

6. Get a Money Saviour:

Along with other tasks, the best accountant should save your money through accounting practices. As accountants are aware of tax laws and regulations; they also know the reliefs and discounts of state on different occasions. So through the help of their knowledge and expertise, they can bring down your liabilities through legal practices.

Want to reduce your financial liabilities, talk to our accountants to find out how they can help!

7. Interview:

To select a suitable accountant, an interview is recommended. As in interviewing, you came to know about the personality of the accountant along with his/her experience and expertise. While interviewing, make a list of questions that you are looking for. Compare the answers of each candidate to make the final decision.

In this way, you’ll get valuable advice and you’d get to know your business requirements clearly.

8. Negotiate Fees:

Find out an accountant who is worth the time and money you’re investing in. As there are no standard charges of an accountant, it varies based on their experience and qualification. Some accountants will charge on an hourly basis, some will charge weekly or monthly and some might charge a percentage from the turnover.

Compare the quotations of the accountant and consider factors that suit your business need. Some accountants might not agree with your pay structure. So it’s better to ask them beforehand.

9. Background of your Accountant:

You should be aware of the background of your accountant. For this, you can contact the previous clients to know more about your accountant. You can use professional services to validate your accountant’s information. This will tell you about the relationship of the accountant with the clients.

10. Go Extra Mile:

If you find someone who’s passionate to go extra mile for your business, this person would be the ideal choice for your business. As if an accountant is willing to do more work than just filing taxes and annual accounts, it’d be great. Like a good accountant will find out government funding, reliefs discounts, and grants for which your business is suitable. A skilled accountant can do crowdfunding, find investors, and sell your share. So select someone who’ll go extra mile for your business.

How We Can Help:

Hopefully, you have got enough information on how to choose right accountant in the UK. If you need our support, we can help you to find the best match for your business.

Accotax is one of the leading accounting and tax consulting agencies in the UK. We have served hundreds of individuals, businesses, and startups to achieve their financial goals. We can go extra mile to grow your business turnover by reducing your charges and taxes by legal compliance. We are aimed at growing your business profit.

Accotax is working for more than a decade in the field and we know what your accounting needs are! For this reason, we’re confident to provide the best service at affordable rates.

Contact us for a customized offer!

Disclaimer: This blog provides general tips to choose the right accountants in the UK.